2015 United States Institutional Investors - Fees Paid - Data

Average fees paid in equities and fixed income show slight decreases in 2015 from the year prior.

Average fees paid in equities and fixed income show slight decreases in 2015 from the year prior.

Allocations to equities and domestic fixed income are expected to decline with flows going to international fixed income and real assets.

Philips, Hager & North holds a significant market position in Canadian fixed income management.

Target date funds continue to occupy a larger proportion of DC investors' portfolios, mainly at the expense of stable value.

DB plans dominate both corporate and public plans, but the use of DC plans among public funds grew by almost 100% from 14% to 27%.

Total Canadian institutional assets grew by 9%, off from last year's increase of 13%.

Pimco and Blackrock hold a significant market position in U.S. fixed income management.

Average fees paid in equities and fixed income show slight decreases in 2015 from the year prior.

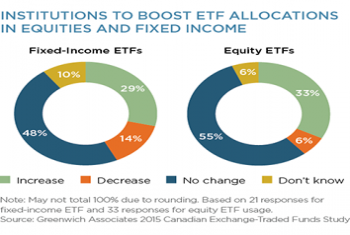

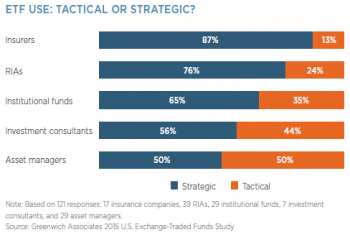

Canadian institutions rank as some of the most active and sophisticated ETF investors in the institutional marketplace.

The growth in institutional investment in exchange-traded funds (ETFs) can be attributed to a single factor, versatility.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder