Respondents kept 66% of average monthly balances on deposit with domestic cash management providers, with their 1st bank.

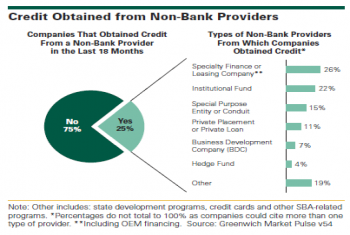

A notable share of U.S. small businesses and middle market companies are obtaining credit from non-bank providers.

Financial stability (counterparty risk) is the most commonly cited reason why banks are chosen as the lead domestic cash management provider.

Risk management - focus on business interruption is considered an extremely high priority by 45% of respondents.

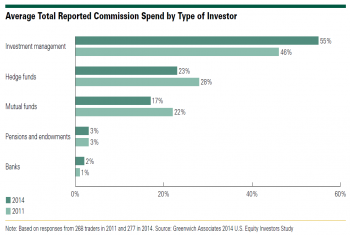

In U.S. equities the main priority is getting paid for what you deliver. Mid-sized brokers and research specialists that are now being paid in large part through CSAs must be careful that they are being adequately compensated for their research.

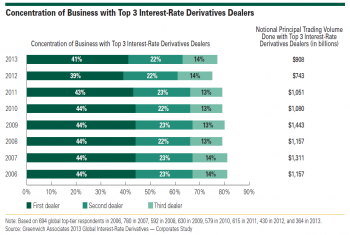

Regulations Having Little Impact on Corporates' Use of Interest-Rate Derivatives

Corporate users continue to concentrate their IRD business among their top three dealers, while asset managers and hedge funds are starting to diversify their lists.

Ranking the best sell-side research across 55 GICS sectors.

U.S. Equities: Limited Growth in E-Trading Due to Market Complexity

Investors’ desire for low-touch trading is tempered by content needs accessible only through high-touch channels.

Mid-tier brokers see strong gains as research source, now accounting for 40% of the research wallet.

U.S. Equities: Demand for Research Drives Uptick in Commission Spend

Despite lower market volumes, U.S. equity investors seeking content drive up the commission wallet.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Business Insider: Eric Li, head of global banking research at Crisil Coalition Greenwich, expressed...August 9, 2025

-

Markets Media: “Consolidated platforms may offer convenience and potential cost savings, but the...August 7, 2025

-

The Desk: Infrastructure funding needs and external debt service obligations in Africa are growing...August 6, 2025