2014 U.S. Equity Investors Most Helpful Sell-Side Equity Traders and Research Professionals - Rankings

This report provides detailed information on the top performing U.S. equity traders and research professionals.

This report provides detailed information on the top performing U.S. equity traders and research professionals.

Compensation figures increased in 2013.

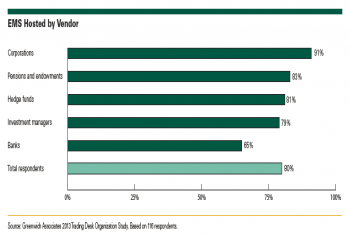

Hedge funds could see IT costs slashed by using cloud computing on demand.

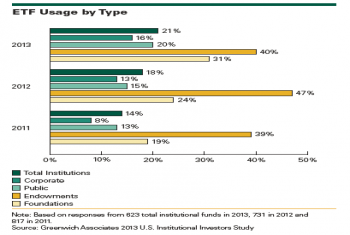

ETF usage is climbing as institutional investors adopt for routine portfolio functions and as a means of obtaining long-term strategic investment exposures.

Buy-side equity traders favor electronic trading for cost, but commission dollar requirements and other issues often curtail use.

Greenwich Associates research finds top foreign exchange dealers can expect increasing market share concentration, while top fixed-income dealers should see more fragmention.

After a paring down on the asset managers in recent years, institutions expect to increase their number of managers as they expect to diversify further and hire for more specialized strategies.

The amount of externally managed current assets grew to $1,574, in 2014 from $1,498 in 2013.

Fund professionals in Thailand report the highest level of investment consultant solicitations.

Government entities were paying higher fees for emerging market fixed income managers this year, whereas their fees for active emerging markets equity managers decreased.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder