2013 United States Institutional Investors - Manager & Product Demand - Graphics

Public pension plans and endowments and foundations have been and are expected to be most active in hiring of managers.

Public pension plans and endowments and foundations have been and are expected to be most active in hiring of managers.

Over 60% of corporate pension funds have closed the primary plan to new employees in an effort to reduce future liabilities.

The majority of investors continue to prefer structuring portfolios by traditional asset classes vs. a risk bucket approach.

Corporate funds clearly intend to further de-risk portfolios, predicting increases to fixed income and decreases to equities.

In corporate DC plans, the proportion of assets in target date funds has nearly tripled since 2008.

As the restructuring of the global fixed-income business continues in 2014 banks around the world experiment to find the right size and commitment levels to keep them both viable and profitable. Amid these sweeping changes, Deutsche Bank has...

Trading volume increased in 2013.

Amid a dramatic slowdown in institutional trading volume of Japanese government bonds (JGBs), Mizuho Securities and Mitsubishi UFJ Morgan Stanley Securities maintained their momentum as the market’s leading dealers.

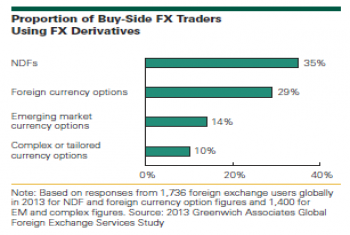

Regulatory-driven changes on the horizon will drive futures to become an important tool in foreign exchange traders’ toolbox.

Fueled by regulatory and client demand, use of third-party TCA vendors now surpasses both proprietary and broker-provided tools among equity, FX and fixed-income traders alike.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder