OTC derivatives volume decreased in 2013.

Fixed-Income E-Trading: Global Trends and Competitive Analysis of Multi-Dealer Platforms

Electronic trading systems increased their share of global fixed-income trading volume in only slightly in 2013, bringing the proportion of total volume executed electronically to 25%. Top fixed-income e-trading platform players continue to...

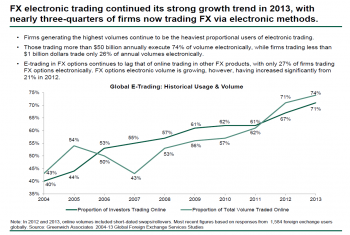

FX Electronic Trading 2014 - Global Trends and Competitive Analysis

As strong growth continues in FX e-trading, regulatory changes and algorithm usage are driving some users back to single-dealer platforms.

2013 Greenwich Leaders: Japanese Equities and Equity Derivatives

Mizuho Securities and SMBC Nikko Securities each gained four percentage points or more of vote share in Japanese equity research and advisory services during in 12-month period...

2013 Greenwich Leaders: Asian Equities and Equity Derivatives

The Asian equity market is attracting fierce competition from a large and diverse group of brokers looking to capture a share of the region’s recovering institutional research and trading business.

Trading volume increased in 2013.

Although Asian banks have been capturing large corporate clients from European rivals, the latest research from Greenwich Associates shows that HSBC has established itself as the leading bank in the region in terms of both number of relationships...

2014 Greenwich Leaders: European Corporate Banking

BNP Paribas has established itself atop the European corporate banking market by securing relationships with 56% of the largest European companies.

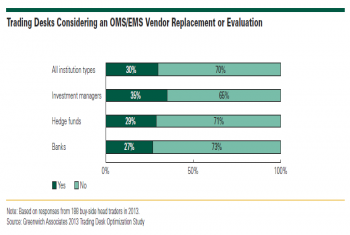

Thirty-nine percent of fixed-income desks reported a year-on-year budget increase and 30% are considering a change in the providers of their order management systems (OMS) or execution management systems (EMS).

Low interest rates and market volatility continue to frustrate intermediaries , challenging them to provide suitable investment options to end-clients, as well as underpinning investor reluctance to fully re-commit to markets and ultimately defining...

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Financial Advisor: Academic research is increasingly probing how generative AI and reinforcement...July 30, 2025

-

Traders: “The ability to source natural liquidity—not just large blocks—is very much on the buy-...July 25, 2025

-

Financial News: Jesse Forster, senior analyst at Crisil Coalition Greenwich, said AI’s potential to...July 21, 2025