Table of Contents

U.K. corporate pension funds and local authorities have diverged almost completely in their portfolio strategies and asset mixes. Nevertheless, on one key issue they are moving in lockstep: Both groups are increasingly considering managers’ ESG approaches when hiring a new manager.

Overall, more than 9 out of 10 U.K. institutions say they have adopted ESG criteria as a factor in making investment and/or external manager selection decisions, up from just 40% in 2016. That adoption is being driven both by new regulations on sustainability and by mounting demands from clients for sustainable investment practices. The issue has become so important that local authorities now rank the incorporation of ESG criteria as the single biggest challenge they face. For corporate pensions, ESG integration ranks third, behind only the essential priorities of liability management and asset allocation.

Institutions in both camps are also paying closer attention to the environmental impact of their own portfolios. As recently as 2019, only a quarter of U.K. institutional investors said they were either tracking their portfolios’ carbon footprints or planned to start doing so in the next 24 months. That share climbed to approximately 60% in 2021.

Local Authorities vs. Corporates: Risk-On, Risk-Off

The alignment between corporate pension funds and local authorities on ESG stands in stark contrast to the clear divisions between the two groups on other issues relating to their strategies and portfolios.

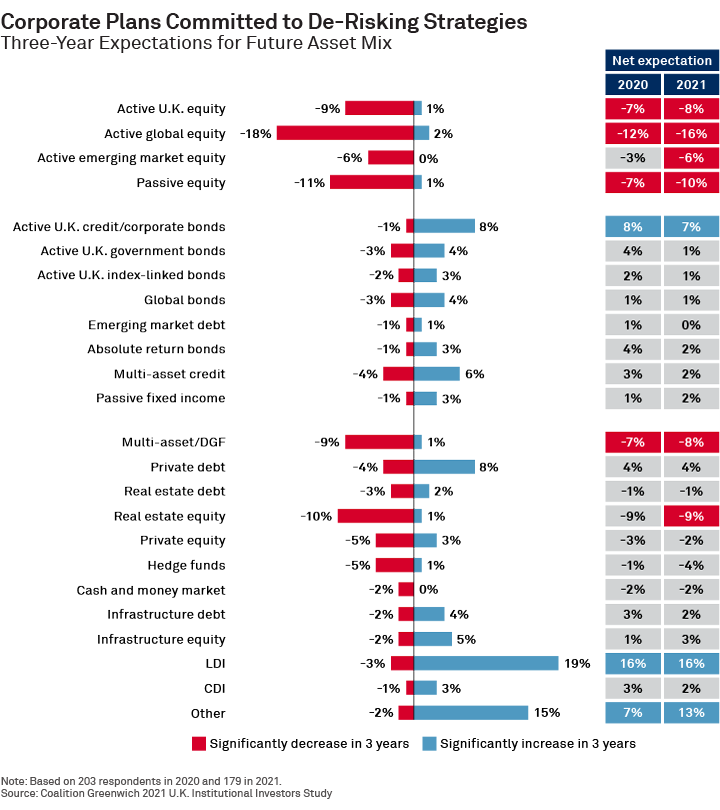

Corporate pension sponsors remain focused on minimizing costs and risks associated with their defined-benefit schemes. Almost 60% of corporate pensions’ assets under management are allocated to either fixed income, which represent roughly a third of assets, or LDI strategies, which make up approximately a quarter. Looking ahead, corporates plan to continue allocating away from equities and multi-asset strategies, with LDI and active U.K. credit expected to be the main beneficiaries.

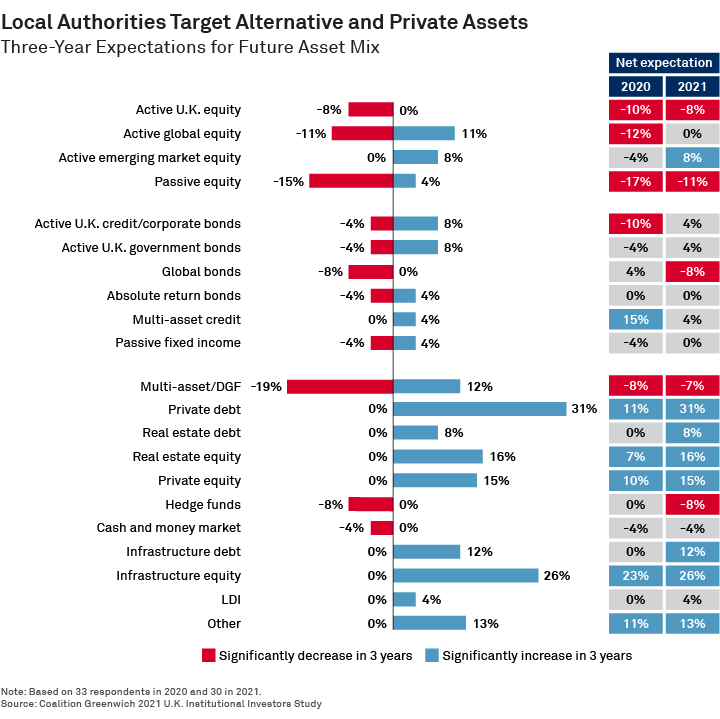

Local-authority portfolios look quite different, with equities accounting for more than half of local authority AUM. Like corporates, local authorities are looking to take down those allocations. However, rather than de-risking, local authorities are looking to add risk by shifting assets into specialist funds and strategies like infrastructure, real estate, private debt, and private equity.

2021 Greenwich Quality Leader

Baillie Gifford, the 2021 Greenwich Quality Leader in Overall U.K. Institutional Investment Management Service, has long been recognized for its superior client service. However, the firm widened the gap between itself and other managers with even higher client service quality ratings during the volatile 12 months of 2020. Throughout the crisis, Baillie Gifford excelled in several key areas, including responsiveness to client requests and the quality of client meetings. “The firm continued to deliver very high levels of service quality during work-from-home,” says Coalition Greenwich consultant Mark Buckley. “In fact, they were one of the very few asset managers that significantly improved client service ratings in this period of stress.”

Consultants Mark Buckley and Sophie Emler advise on the investment management market in the United Kingdom.

MethodologyBetween January and April 2021, Coalition Greenwich conducted in-depth interviews with 318 key decision-makers at the largest institutional funds in the United Kingdom. Institutions included U.K. corporate funds, local authorities and other institutional funds, each with over £75 million in total defined-benefit plan assets, defined-contribution plan assets or other institutional assets.