Corporates globally rely on us for unbiased peer to peer data, insights and analytics to make informed and strategic business decisions about their provider relationships.

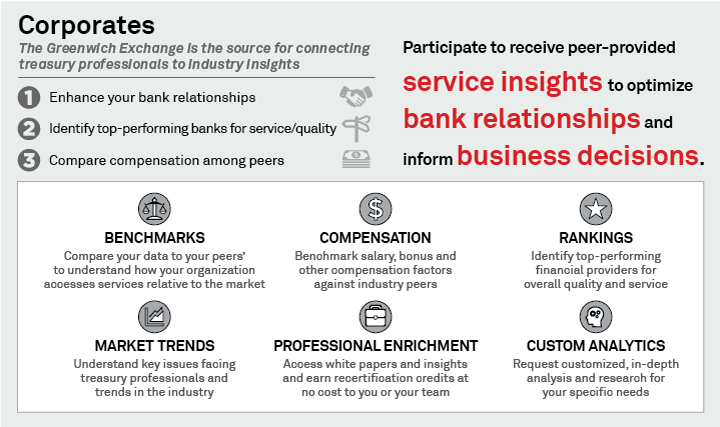

If you are a senior-level finance executive, you have an opportunity to participate in the Greenwich Exchange. This exchange of your data and insights about the quality of products and services you receive from your financial service providers gives you access to valuable, proprietary content from Crisil Coalition Greenwich. We currently partner with over 5,000 senior corporate treasury professionals annually.

To participate, please submit your contact details in the form. Your contact information will be handled securely and, in accordance with our privacy policy, will only be used for the purpose of this research study.

Global companies seek strategies for tariff turbulence

June 3, 2025

Nearly half (46%) of U.S. companies say they are diversifying suppliers, or drawing up plans to do so, presumably to lower exposure to China (and potentially to other Asian countries like Vietnam.

May 16, 2025

Understand how recent changes in tariff policies impacted a company’s financial strategy. Gain insight into how tariff policies prompted shifts in company’s supply chain corridors or logistics strategies.

2024 European Corporate Trade Finance Rankings Report

April 17, 2024

View more about the market composition and key players across country clusters and sectors, and qualitative assessment & key selection criteria across country clusters and sectors, for corporates in the European corporate trade finance study.

Poly-crisis is driving trade finance digitalization

April 15, 2025

A continuous economic and geopolitical ‘poly-crisis’ is creating a powerful incentive for companies around the world to invest in trade finance and supply chain management capabilities. This new focus is accelerating digitisation and opening the door to next-gen solutions with the potential to make these core corporate functions more transparent, flexible and efficient.

2024 European Trade Finance Insights

October 24, 2024

This report provides detailed information on European trade finance, including insights on the impact from Supply Chain Disruption, top players used for European Trade Finance, Money in Motion, Top Driver of Business Momentum, Cross-Border Trade Finance Usage, and more.

Asian Trade Finance: Facing Challenges, Corporates Diversify and Digitize

October 1, 2024

Macroeconomic headwinds and geopolitical challenges continue to buffet global trade. Asian companies hoping that trade would normalize quickly after the effects of the pandemic faded are still grappling with challenges in 2024.

2024 Asian Trade Finance Insights

September 23, 2024

This report provides detailed information on Asian trade finance, including insights from key trade finance decision makers on Asia trade volumes, impact from supply chain disruption, key challenges faced by corporations, and more.

Best Practices for Bank Account Management

April 16, 2024

Bank Account Management (BAM) consists of the policies, procedures and actions corporates follow to open, close or modify bank accounts held by their financial institutions.