Alternative data or “alt data” are new, unique data sources that can add valuable explanatory power to both quantitative and fundamental investment models. Originally, alt data for investment and trading decisions was procured separately from traditional market data. Today, however, traditional financial information vendors have expanded into this market and are developing offerings and marketplaces tailored to this new segment. Some are also doing the heavy lifting to make alt data more consumable via normalization and application programming interfaces (APIs).

Alternative data sources, alongside factors related to environmental, social and governance (ESG) investing, are increasing the data points used in the investment process and highlighting the need for better data management. Most investment managers today are not satisfied with how well alt data is incorporated into their investment decisions. With the hundreds of alt datasets available, it’s not exactly easy.

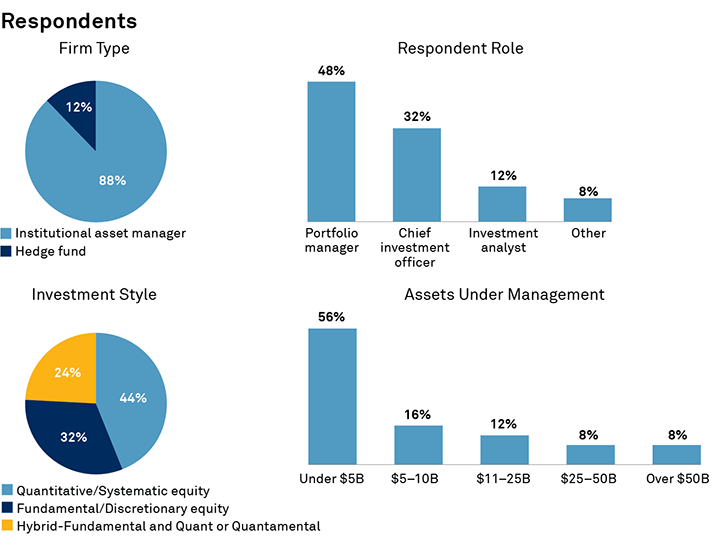

MethodologyBetween May and July 2021, we interviewed 25 executives at asset managers and hedge funds to better understand the usage of alt data, spending trends, types of datasets used, and pain points in adoption. Respondents mostly comprised asset managers and included a mix of investment styles. We spoke with investment professionals including portfolio managers, chief investment officers, investment analysts, and others.