Table of Contents

The COVID-19 pandemic has affected economies and financial markets in unprecedented ways. Throughout this period, corporate treasurers and institutional investors have had to deal with a myriad of risks, including managing portfolio, operational, market, and currency risk.

This blog is part of the Navigating Turbulent Markets series.

In late May through early June, as economies started to reopen, we collected feedback from over 135 corporate treasurers and institutional investors globally to learn about the impact of COVID-19 on their FX trading behavior, which dealers stood by them, and their investments and expectations for the future. The results show several similarities but also stark differences between corporates and financials across the regions.

Foreign exchange is one of the most electronic markets, with roughly 80% of volume in the $6 trillion per day market traded across a host of electronic trading channels and protocols.

Anecdotal feedback from both dealers and buy-side accounts suggests that at the height of market volatility in March, as market makers and clients began to adjust to home trading environments, bid-ask spreads in FX widened—if only reflecting prevailing market conditions.

Voice Trading Becomes More Important

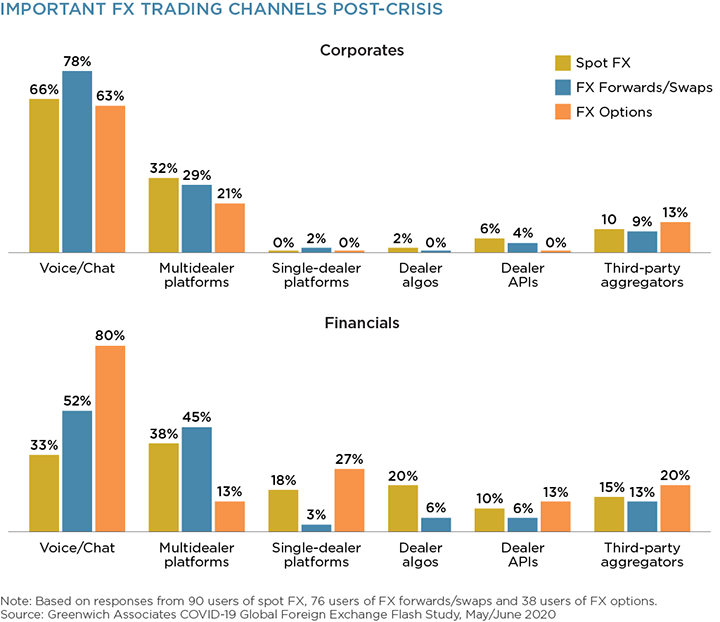

We asked clients which trading channels/protocols they used more during the crisis and expect to continue using going forward.

Across FX products, corporate treasurers relied most on voice/chat-based trading, with only one-third citing multidealer platforms as their preferred channel. Among institutional FX users, Asian buy-siders relied more on their bilateral dealer relationships (via both voice and dealers’ single-bank platforms). North American and European accounts’ preferred trading channel varied more by product and region.

Even in spot FX, the FX product where financials typically trade over 80% of their flows electronically, Asian financials now rank voice/chat higher than other electronic channels.

Globally, dealer execution algos have become an important trading protocol. This indicates that while reported volumes on multi-bank platforms increased over the COVID period, the overall trading share of these platforms would have declined. Banks’ generally strong Q1 results in FICC reflect the elevated trading volumes in the early stages of the crisis.

In currency options, a part of the market that remains more reliant on voice/chat-based trading, the results favoring this channel are not surprising—albeit conversations with some banks have indicated currency options volumes had declined in March and April.

Clients Expect Increased Trading in G10 Cash Products and FX Options

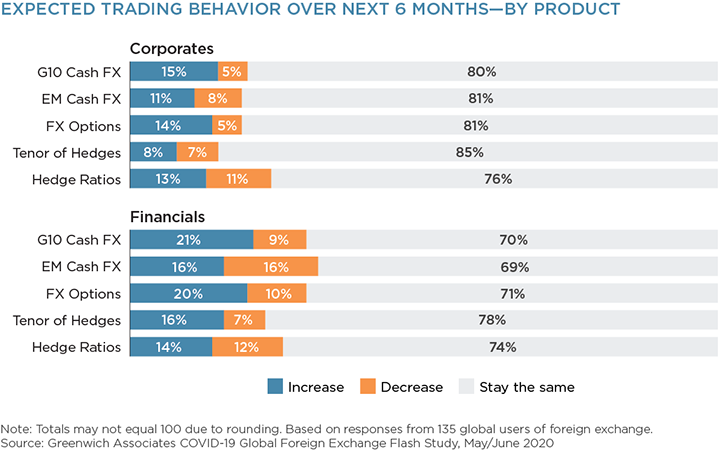

So how do clients expect their trading behavior to evolve in the next six months? Since March, the U.S. dollar and other G10 currencies have risen sharply against most emerging market currencies.

Looking ahead, a large majority of corporate and institutional clients expect their FX trading activity, hedge ratios and tenor of hedges to remain at similar levels relative to the same period last year. However, more clients expect their G10 cash (spot/swaps/forwards) and FX options volumes to increase versus those that expect a decline.

At the same time, expectations for EM cash currency trading activity is net neutral. Given that investors have recently shifted their investments into developed markets products, the results here come as no surprise.

Digital: Buy-Siders Shifting their Technology Focus

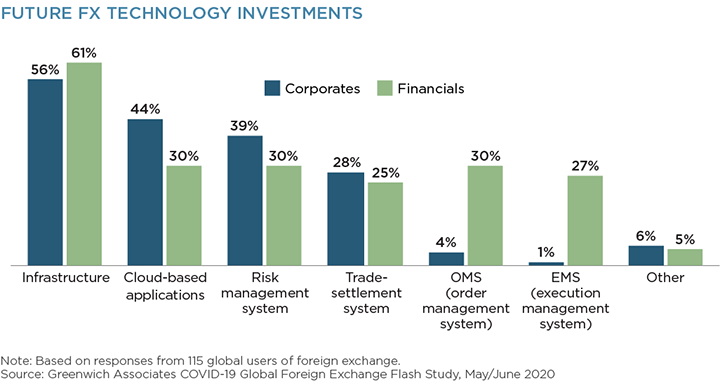

If there is one thing no one is disputing, it is that COVID-19 will accelerate digitization in many areas. And while most industries have been moving in this direction, the most immediate focus for corporates and financial institutions today is to shift investments toward infrastructure to support the “new normal” environment.

For many FX users, there will be an increasing focus on cloud-based applications, but importantly, also digitizing their risk management and trade settlement systems. In addition to these, a substantial proportion of institutional investors also plan to upgrade/invest in OMS/EMS systems.

Given that all these areas require substantial financial commitments and have high switching costs, these are long-term investments. The industry will look for the most-trusted technology vendors, favoring those that offer the most seamless and timely integration with their existing environment. The onus is on the providers to win these mandates.

Standout Dealers During the Crisis

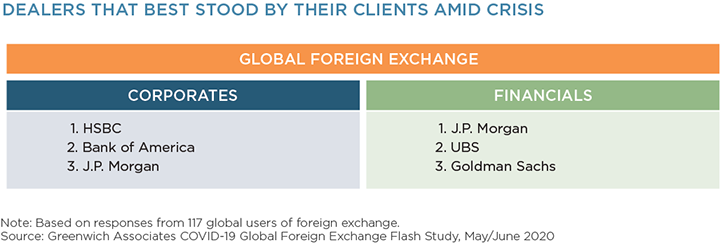

As we have done in this series across fixed-income & equity markets, we asked corporates and institutional FX users to tell us which dealers stood by them the best during the recent turbulent market conditions.

Interestingly, while many clients recognized between one and five dealers on this, nearly a quarter simply said “all of their dealers.” This is impressive and in sharp contrast to the feedback we received in fixed income, where a similar percentage of clients named “none.” This is testament to the more robust e-trading environment in FX markets.

Leading Dealers: Among corporates, HSBC stands out at the top, followed by BofA Securities and J.P. Morgan. Among financials, J.P. Morgan leads, followed closely by UBS, and then Goldman Sachs. The difference in results between the two major client segments reflects their franchises and focus, and it is worth adding that the list of other dealers getting recognition from clients is longer than in other asset classes.

What Do FX Clients Want from their Dealers?

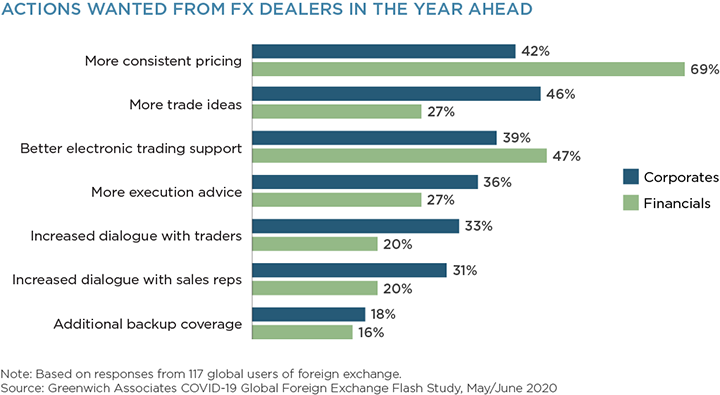

Unsurprisingly, corporates and institutional clients have different priorities and expectations from their FX dealers. Nearly 70% of institutions would like to see “more consistent pricing,” whereas corporates most frequently mention “more trade ideas.” Clearly, institutional investors have a fiduciary responsibility to their clients, and best execution remains paramount. Meanwhile corporate clients want to be better prepared to manage their exposures.

The one area that both these client segments consider important is “better electronic trading support.” While most dealers now have dedicated e-sales and support teams, perhaps there is still more they need to do. At the same time, it is important to highlight that nearly a third of corporates and 1 in 5 financials would like increased dialogue with their sales reps and sell-side traders.

What’s Next for Dealers?

It is fair to say that the FX market held up well during the crisis. This reflects the infrastructure investments that all market participants have made over the last few years. However, the increased prevalence of voice trading, and the importance FX users are assigning to advice and support, demonstrates the ongoing importance of relationships even in this most electronic of markets.

Partnering with Clients in a Time of Market Turmoil

COVID-19 Impact on FICC Markets

COVID-19 Impact on Equity Markets

Uncharted Territory in European Fixed Income

European Fixed Income: Standout Dealers Amid Crisis

Recognizing Standout Equity Trading Brokers Amid Market Turmoil

COVID-19 Impact on Asian Fixed Income – Turning Crisis into Opportunity