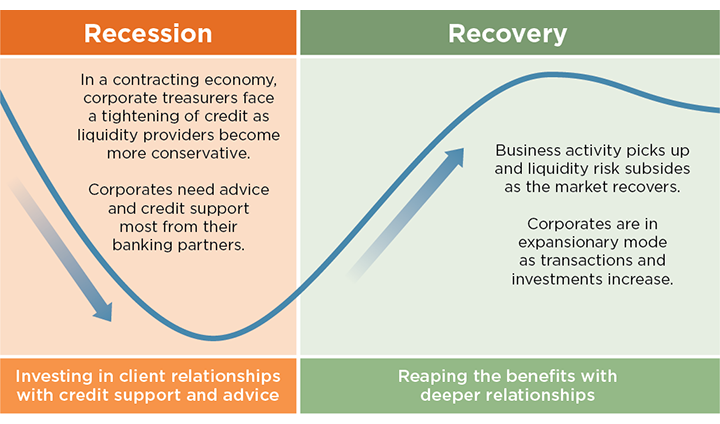

Inarguably, COVID-19 has precipitated an unprecedented slowdown in economic activity across the world, adversely impacting people, businesses and sectors. As corporates attempt to secure additional funding during the downturn, banks (and other lending institutions) play an integral role in fostering robust and enduring relationships with their corporate clients.

We recently reviewed the key drivers of relationships between large corporates across the world and their banking partners through different periods of the economic cycle. Notably, in the 10 years following the 2008 global financial crisis (GFC), financial service providers who provided strong support to corporates during the crisis have emerged with a much higher likelihood of deepening these relationships.

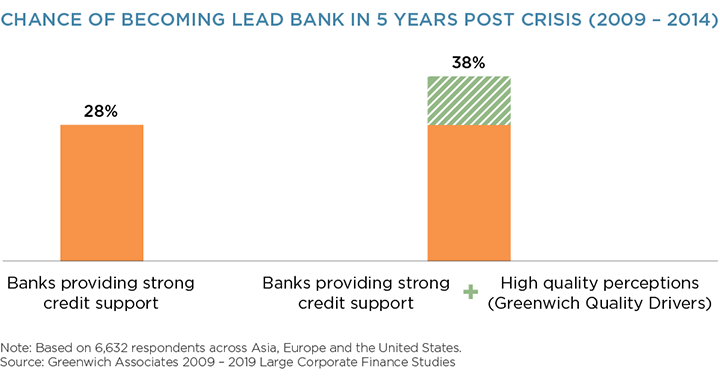

These data-driven insights reveal that the "institutional memory" of corporates lasts approximately 5 years supported by the findings that the banks who provided credit support to their key clients in 2009 had a 28% chance of becoming a "lead (No. 1)" bank in the next 5 years.

In addition, when these banks matched the provision of credit support with “high” perceptions on Greenwich Quality Drivers, their chances of rising up to a lead position with clients increased to 38%.

While "institutional memory" may begin fading after 5 years, the advantage banks can gain during crises is still likely to endure as long as they remain competitive by constantly investing in improving the quality perception of their products, platforms and people capabilities.

Now is the right time for banks to embark on a relationship-building journey with their corporate clients. Contact us to learn more about the main drivers of corporate banking quality perceptions that will help financial institutions be successful in this challenging environment.