The second quarter of 2020 will go down in history as being the event that pushed the financial services industry to rethink their customer experience model. Sure, banks have business contingency plan but no one could have anticipated the scale and longevity of COVID-19’s impact on traditional customer servicing methods, risk, and digital adoption.

At the onset of the crisis, branches closed, and relationship managers took customer meetings on video conference. Traditional and PPP loans were facilitated by an “all hands” approach to support the overwhelming client need, and banks pivoted their models to adapt [see COVID-19 Impact on Bank Servicing Models].

Those organizations truly committed to customer experience prior to the pandemic thrived in the crisis relative to large bank competitors. Employees had an embedded mindset of putting the customer’s needs first, and customer loyalty thrived among those organizations. These banks continued to speak with their customers through shortened surveys asking only relevant, in-the-moment questions that empowered the bank to adjust quickly to better meet customers’ needs.

In contrast, organizations that lacked a customer-centric culture suffered as customers migrated to banks willing to showing empathetic servicing while going the extra mile. Now, those customers are moving their entire banking relationships.

Those industry leaders developed and implemented action plans across nearly every area of the organization. When the time came to prove their customer-centric culture, they moved into action because it was the expected course of doing business. This even included fast-tracking implementation of e-signature capabilities so often debated by risk, compliance, and legal teams at many banks.

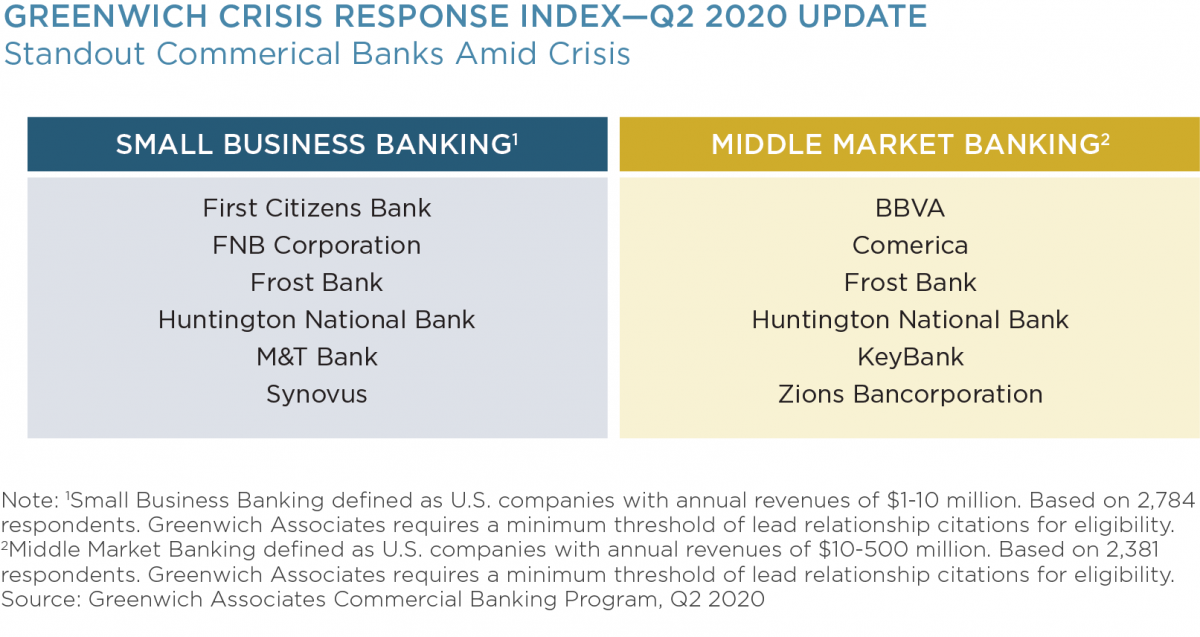

Greenwich Associates recently identified leading commercial banking institutions who have been viewed as “Standouts ” in their response to small business and middle market companies during Q2 2020.

Above all, COVID-19 brought banking customer experience back to client centricity, and encouraged commercial banking executives to focus their efforts on key areas as previously covered in Top 5 Reasons CX Programs Fail to Deliver…and How to Avoid Them.

- Customer Journey

- Data Simplicity

- Actionable Data (and taking that action)

- Asking the Right Questions

- Employee Alignment We welcome the opportunity to share additional information about how expectations and perceptions are changing in commercial banking during this crisis.

Connect with us to learn more.