Table of Contents

Large corporates in Asia are renewing efforts to improve the resilience and sustainability of their supply chains in keeping with larger environmental, social and governance (ESG) goals. However, while technology is catalysing the change, end-to-end digitalisation of trade finance will require regulatory push, panelists at the Coalition Greenwich webinar Corporate Finance Forum: Asian Trade Finance & Supply Chain pointed out.

Gaurav Arora, Head of APAC, Coalition Greenwich, anchored the webinar held on July 28, 2021.

The Structural Shifts

The 2021 Coalition Greenwich Large Corporate Trade Finance Study shows global trade volumes have rebounded sharply from the slump witnessed in the first half of 2020, with Asia leading from the front. However, supply chain, economic and geopolitical risks continue to be top of the mind.

Indeed, post-pandemic shocks, together with the commodity super-cycle, shortage of components such as chips, rising freight costs, and ongoing geopolitical tensions, are causing structural shifts. For instance, inventory management has moved from just-in-time to building a buffer for a rainy day. Further, companies are diversifying supply chains beyond a single geography or a concentrated set of suppliers.

Says Kanika Thakur, Managing Director, Asia Pacific Trade Head, Citi: “Corporates are focused on ensuring their ecosystems are geared for future shocks. And banks are getting involved in building the sustainability and resilience of their supply chains.” Supporting these client priorities, Citi has onboarded a record number of suppliers in Asia Pacific in the first half of 2021.

Sofia Hammoucha, Managing Director and Head of Transaction Banking, South East Asia, BNP Paribas, feels COVID-19 has accelerated structural diversification. Manufacturing hubs in countries such as Vietnam, Thailand and Indonesia are benefitting from this shift. “This will continue to be a relevant factor because of geopolitical tensions and ESG,” she says.

Standard Chartered Bank has identified four key elements to determine resilience, says Maisie Chong, the bank’s Head of Trade, ASEAN and Singapore. These include an environmentally sound and transparent supply chain, financial robustness to support the smallest suppliers, flexibility and responsiveness to shocks, and collaborative communication across participants.

While the region’s corporates still place more focus on assessing their direct supplier relationships than indirect ones when it comes to enhancing the resilience of their trade ecosystems, they recognise the need for diversification and greater transparency and are striving to advance their sustainability goals, Maisie Chong added.

“Asian corporates are asking what their peers are doing and how they’re operating, as well as the rules of the supply chain” to benchmark themselves and learn from industry best practices, she said. “There is definitely a shift and they are working towards building a more resilient supply chain.”

Regulatory Impetus Crucial for Digitalisation

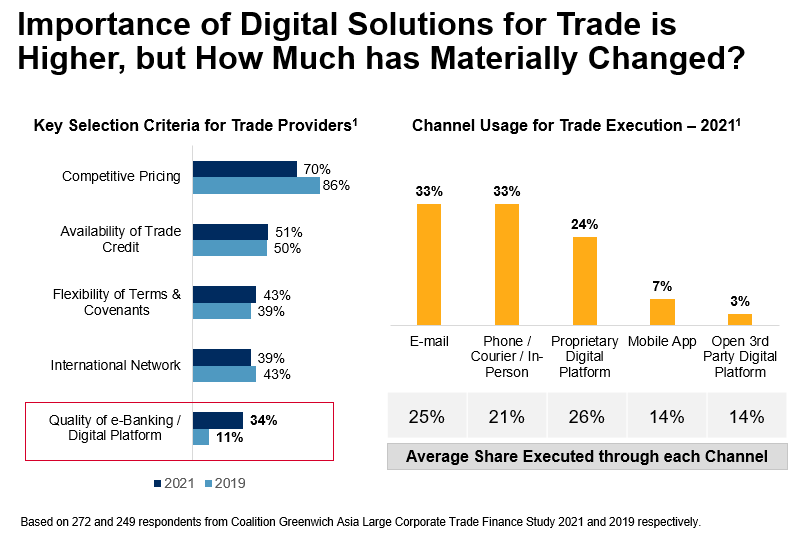

Companies are turning to technology to enable the transition. Coalition Greenwich’s Asia Large Corporate Finance Study 2021 shows that although competitive pricing remains the number one factor for choosing trade finance partners, its importance has reduced, while that of electronic banking and digital platforms has risen three-fold in the past two years. The share of execution through proprietary and third-party digital platforms and mobile apps is also higher than traditional channels.

Again, COVID-19 has accelerated the digitalisation journey for all participants – from corporates, suppliers and shipping agents to banks and fintechs, to governments and regulators. However, the paper-heavy, multi-party and multiple-process nature of trade finance poses a huge challenge, and players are addressing this through solutions such as e-procurement and dynamic discounting.

Kanika Thakur says Citi is addressing digitalisation on three fronts: how it processes trades digitally, how it connects with its clients for their trade needs, and how the trade ecosystem functions.

“We are leveraging technologies like artificial intelligence to provide faster services and also have more robust operational controls to prevent fraud and have a regulatory-compliant shop,” says Kanika Thakur. The bank has also invested in proprietary platforms for connectivity, she says, adding, “More importantly, we've simplified the underlying documentation and processes because that’s the real value.”

However, says Sofia Hammoucha, “The actual leap that will drive digitalisation of trade finance is regulation and legal reforms. Technology remains the catalyst and facilitator, but it's definitely not the ultimate solution.”That’s because trade finance entails cross-jurisdiction change of ownership of goods with its attendant legal documentation, she points out. Some regulatory efforts have begun, notably the recent introduction of electronic bills of lading by Singapore, though.

Kanika Thakur says: “In a nirvana state, you'd want one inter-operable system where all parties can log in and everything goes through digitally. We're not near that yet but everybody's doing bits and pieces to get there, and simplifying processes.”

Adds Sofia Hammoucha: “The easy way is to start is on your own perimeter. Singapore and Hong Kong are at the forefront here. It's nascent but we're seeing a real understanding that digitalisation will have to go through legal and regulatory aspects.”

Indeed, regulators play a critical role in driving the industry development. Providing guidelines and promoting the essential business technology could help increase corporates’ digitalisation efforts and expedite adoption of new technologies, Maisie Chong said.

That apart, collaboration between banks and third-party fintech providers will also be key, points out Maisie Chong. And what could tie it all together is a business-friendly policy framework on digital trade across the region, she added.

Sustainability is the Future

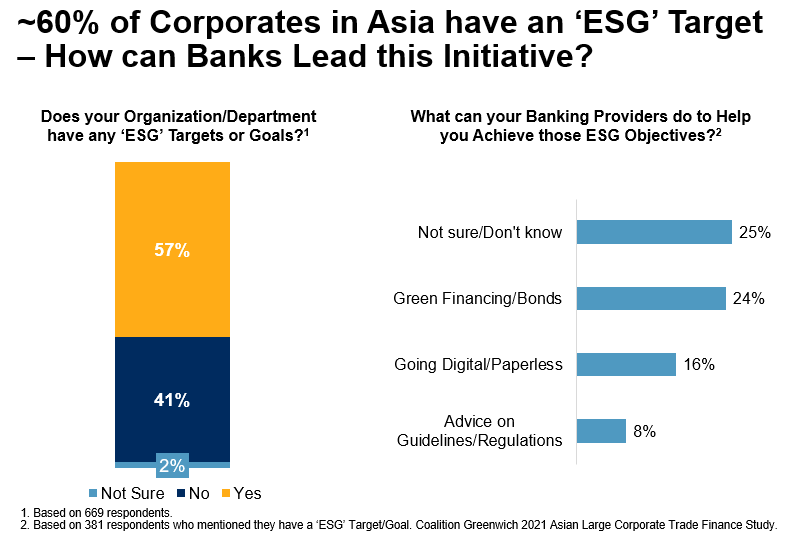

The thrust is equally on supply chain sustainability, going forward. Again, the Coalition Greenwich study shows that more than half the corporates surveyed have defined their ESG goals. However, this has not trickled down from green financing of projects to working capital finance yet.

Sofia Hammoucha points out that while Asian regulators are pushing for the inclusion of ESG norms in the working capital cycle – BNP Paribas has developed a sustainable supplier financing framework with authorities in Singapore, for instance – the uptake is slow because of two key challenges. “The first is that ESG KPIs [key performance indicators] are still at the broad corporate level and have not yet translated down to the treasury. The second is that unlike project finance, which is long-term, working capital financing is short term and the effort required to assess sustainability goals and monitor them is still too heavy for treasurers. It's our responsibility as banks to make this more accessible,” she says.

Kanika Thakur believes banks need to adopt different strategies as local and multinational companies are at different stages of readiness. For instance, Citi rolled out a pilot ESG supply finance programme for a fast-moving consumer goods company, which “has strong replicability and will be the bedrock of our ESG agenda in trade”.

“The other critical trade ESG solution is agency-backed financing, which is more medium term. We’ve had some success with this in Indonesia. Lastly, we’re looking at working capital loans, where complexity is the highest because how do you measure improvement in KPIs if it is episodic or short tenor. We are focusing on end use and have done a transaction where the proceeds were used for rice farmers on a rice exchange led by a multilateral with clear demonstration of the ESG benefit,” says Kanika Thakur.

Going forward, ESG in trade finance will be centred around three Cs – carbon, collaboration and compromise – believes Maisie Chong. “MNCs are leading on ESG. The challenge would be their suppliers in emerging markets. We see a lot of collaboration between them to take the ESG agenda forward,” she says.

However, 78% of the companies surveyed by Standard Chartered in its recent Carbon Dated report plan to remove suppliers that endanger their carbon transition plan by 2025. “This could translate into potential loss of export revenue. I would urge corporates and their suppliers to work closely together to transition and achieve their shared goals,” says Maisie Chong.

Also, the ESG conversation has largely centred around environmental concerns, but COVID-19 has highlighted the impact of loss of income, points out Sofia Hammoucha. She says: “The societal impact and how we can help corporates move the needle on that through our financing structures will become more and more central to the conversation.”