Buy-side traders are doubling down on transaction cost analysis (TCA) as a crucial tool to optimize performance and boost returns. With trading growing increasingly complex and competitive, the ability to accurately measure and minimize transaction costs has become a key differentiator for investors seeking to maximize returns.

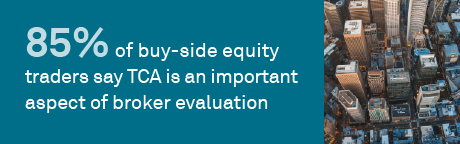

Every buy-side desk in our study conducted TCA for their equity trading in the past year, with almost 80% doing so at least quarterly. Brokers and TCA providers take note: A whopping 85% of buy-side traders rely on quantified TCA to assess broker trade performance, with 20% using it as their primary metric. Just 5% consider it unimportant in their review process.

The days of TCA as a mere box-checking exercise for best-ex reviews and compliance meetings are fading. Today, it’s a vital component of a head trader’s toolkit, empowering institutions to refine their strategies, optimize performance and, ultimately, enhance their portfolio returns. In a world where every basis point counts, TCA is no longer a nice-to-have, but a must-have. By harnessing the power of TCA,firms can gain a competitive edge, optimize their trading strategies and deliver better returns to their investors.

MethodologyFrom July through September 2024, Coalition Greenwich interviewed 40 buy-side equity traders in North America. The study was conducted over the phone, online and in-person. Respondents answered a series of qualitative and quantitative questions about their daily workflow, broker selection and evaluation, technology platforms used, commissions, technology budgets, and business practices in the U.S. cash equity space.