As AI Technology Matures, Executives are Increasingly Open to Robo-Advisers and expect 24-hour Credit Decisions

January 30, 2018

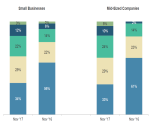

Owners and executives of small and mid-sized companies are taking their experiences and expectations as online consumers to their bank relationships.