Greenwich Associates today announced the 2015 Greenwich Share and Quality Leaders in Flow Equity Derivatives and Convertibles in Europe and North America.

Press Releases

RBC Capital Markets Leads Canadian Corporate Banking Industry

November 5, 2015

RBC Capital Markets continues as the clear leader in Canadian corporate banking this year by securing the top spot in investment banking, debt capital markets, equity capital markets, large corporate cash management, and trade finance.

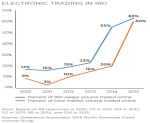

Interest-Rate Derivative Trading Goes Electronic, But Investors Still Lean on Sell-side Salespeople

October 28, 2015

The business of trading interest-rate swaps is moving to electronic platforms at breakneck speed, largely driven by the implementation of Dodd-Frank.

Indian Corporate Banking: Domestic Banks on the Rise

October 28, 2015

Domestic banks are expanding their footprints among India’s largest companies as foreign competitors reposition their business strategies in India and around the world.

Following the Successful Integration of Javelin, Greenwich Associates Announces New Management Team

October 19, 2015

Greenwich Associates today announced the appointment of a new management team for Javelin Strategy & Research. Chris McDonnell will be responsible for sales and business development.

Bank relationship rationalization and the easing of concerns about counterparty risk in the U.S. are setting the stage for increased concentration of corporate banking business in the hands of the market’s biggest banks.

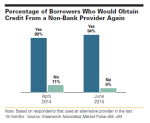

One in Four U.S. Small Businesses and Mid-Sized Companies Borrows From Non-Bank Lenders

October 15, 2015

One in four of U.S. small businesses and mid-sized companies are obtaining credit from non-bank providers, and—in a finding sure to catch the attention of bank executives—nearly all say the experience was so positive that they would borrow from non-bank lenders again.

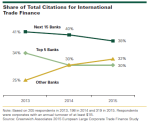

BNP Paribas Leads Market Penetration in European Trade Finance

October 13, 2015

Large European companies are lowering costs and simplifying operations by consolidating trade finance business in the hands of large banks like BNP Paribas, Deutsche Bank and HSBC.

As U.S. Treasury Dealers Step Back From Market-Making, Alternative Liquidity Providers Emerge

October 13, 2015

More than 50% of top U.S. Treasury dealers have stopped actively making markets on interdealer platforms—a dramatic change to a market in which virtually all leading dealers once performed this function.

Big Banks Capitalize on U.S. Companies' Growing Demand for International Trade Finance

October 12, 2015

The market’s biggest banks are expanding their footprints in trade finance as large U.S. companies seek support for their expanding international businesses.

Pages

Media Contact

Media Inquiry

Awards

- 2026 Coalition Greenwich Awards: Middle Market Banking in the U.S.

- 2026 Coalition Greenwich Awards: Small Business Banking in the U.S.

- 2026 Coalition Greenwich Awards: U.K. Commercial Banking

- 2026 Coalition Greenwich Awards: U.S. Corporate Banking, Cash Management and FX

- 2026 Coalition Greenwich Awards: Europe Corporate Banking, Cash Management and FX