To rank among the best electronic banking offerings today, a platform must securely deliver information to smartphones and tablets and facilitate fully integrated payments.

Press Releases

The top five dealers in global foreign exchange trading collectively ceded market share to rivals last year.

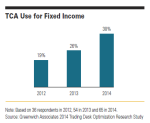

Increased Market Complexity Drives FI Investors to Adopt TCA

April 29, 2015

As new regulations and changes to market structure make fixed-income markets more complex, a growing number of institutional investors are adopting transaction cost analysis (TCA) to assess the effectiveness of trades.

A new report from Greenwich Associates, In-House is Out as OMS and EMS Vendors Continue to Up Their Game, found that as institutional trading desks discard in-house technology in favor of outsourced systems, technology providers are working hard to meet the changing needs of the market.

Social media is joining traditional financial news media as a key source of information used by institutional investors in their investment processes.

First Comprehensive Study of Global Equity Trade Commissions Finds Wide Variation in Rates Paid by Institutional Investors

April 13, 2015

Most investors understand that commission rates on equity trades vary from country to country and from developed to emerging markets, but new research from Greenwich Associates reveals that rates also vary to a huge extent from investor to investor within markets.

Canadian investment managers are working to meet institutional investors’ growing demands for advice and assistance by expanding and upgrading client service capabilities.

Intermediary distributors of investment funds expect record-low returns in European government bonds to continue to fuel a dramatic shift of client assets into a wide range of products including equities, emerging market and corporate bonds, multi-asset products and alternative investments, according to a new study from Greenwich Associates.

Announcing Greenwich Quality Leaders in U.S. Institutional Investment Management Services

March 30, 2015

U.S. Investment management firms continue to build their client service capabilities as a means of deepening relationships.

For the past two years, small businesses and mid-sized companies have become increasingly happy about the status of their banking relationships.

Pages

Media Contact

Media Inquiry

Awards

- 2026 Coalition Greenwich Awards: Middle Market Banking in the U.S.

- 2026 Coalition Greenwich Awards: Small Business Banking in the U.S.

- 2026 Coalition Greenwich Awards: U.K. Commercial Banking

- 2026 Coalition Greenwich Awards: U.S. Corporate Banking, Cash Management and FX

- 2026 Coalition Greenwich Awards: Europe Corporate Banking, Cash Management and FX