Europe’s bond markets are going electronic. Fifty-seven percent of trading volume in European government bonds was executed electronically in 2014—up 14 percentage points since the onset of the global financial crisis.

Press Releases

Greenwich Associates Partners with ResponseTek to Offer Financial Services Clients a Next Generation Customer Experience Management Solution

March 19, 2015

Greenwich Associates, the leading provider of global market intelligence and advisory services to the financial services industry, and ResponseTek, a global leader in customer experience management (CEM) software for large enterprises, have formed a strategic alliance to create a best-in-class, end-to-end customer experience solution for the North American financial services industry.

A movement by financial institutions and regulators to develop standardized processes and technology for managing the risk associated with sophisticated financial models would lower costs and potentially reduce systemic risk, according to a new report from Greenwich Associates.

Regions Bank Takes Top Honors in Greenwich Excellence Awards For Small Business Banking

March 17, 2015

Regions Bank outpaced all rivals by claiming 16 Greenwich Excellence Awards in Small Business Banking.

Zions Bancorp Takes Top Honors in Greenwich Excellence Awards for Middle Market Banking

March 16, 2015

At a time when it’s harder than ever for banks to stand out for the quality of service delivered to middle-market business clients, Zions Bancorp did exactly that in 2014 and earned 13 Greenwich Excellence Awards in Middle Market Banking.

Citi and Deutsche Bank Deadlocked Atop Global FX Market

March 12, 2015

Citi and Deutsche Bank top the list of 2015 Greenwich Leaders in Global Foreign Exchange.

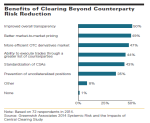

Investors Say Central Clearing Has Reduced Systemic Risk, But Lack Detailed Understanding of Clearinghouse Risk Practices

March 10, 2015

Eighty percent of institutional investors believe that mandatory central clearing of derivatives has reduced systemic risk in global financial markets.

New TCA Model Finds Futures Usage Set to Grow

March 9, 2015

Futures products will gain traction among global investors in coming years at the expense of more standardized cleared swaps according to new research from Greenwich Associates.

Gov't Bond Buying Boosts Domestic Banks in Japanese Fixed-Income Trading

February 23, 2015

Yen fixed-income trading volume (excluding Bank of Japan bond buying volume) increased approximately 25% this past year and the aggregate market share of the five largest Japanese dealers now accounts for more than 56%.

Despite the rise of regional Asian banks, aggressive competition from Japanese lenders and the presence of several ambitious global rivals, the dominant roles of HSBC, Standard Chartered and Citi appear relatively secure.

Pages

Media Contact

Media Inquiry

Awards

- 2026 Coalition Greenwich Awards: Middle Market Banking in the U.S.

- 2026 Coalition Greenwich Awards: Small Business Banking in the U.S.

- 2026 Coalition Greenwich Awards: U.K. Commercial Banking

- 2026 Coalition Greenwich Awards: U.S. Corporate Banking, Cash Management and FX

- 2026 Coalition Greenwich Awards: Europe Corporate Banking, Cash Management and FX