Table of Contents

The global novel coronavirus (COVID-19) pandemic has pushed national economies and health systems into crisis mode, seemingly overnight.

As the number of positive cases and fatalities, as well as the virus’ reach, escalates at an alarming pace, world leaders and politicians have begun to take drastic measures in an effort to control the spread of the disease and keep financial markets in check.

In the meantime, institutional investors are questioning what, if anything, they can or should be doing during this time to insulate their portfolios from long-term damage. In dark periods like this, asset managers that step up to the plate and offer compassionate, relevant and reassuring advice can stand out as shiny beacons of hope.

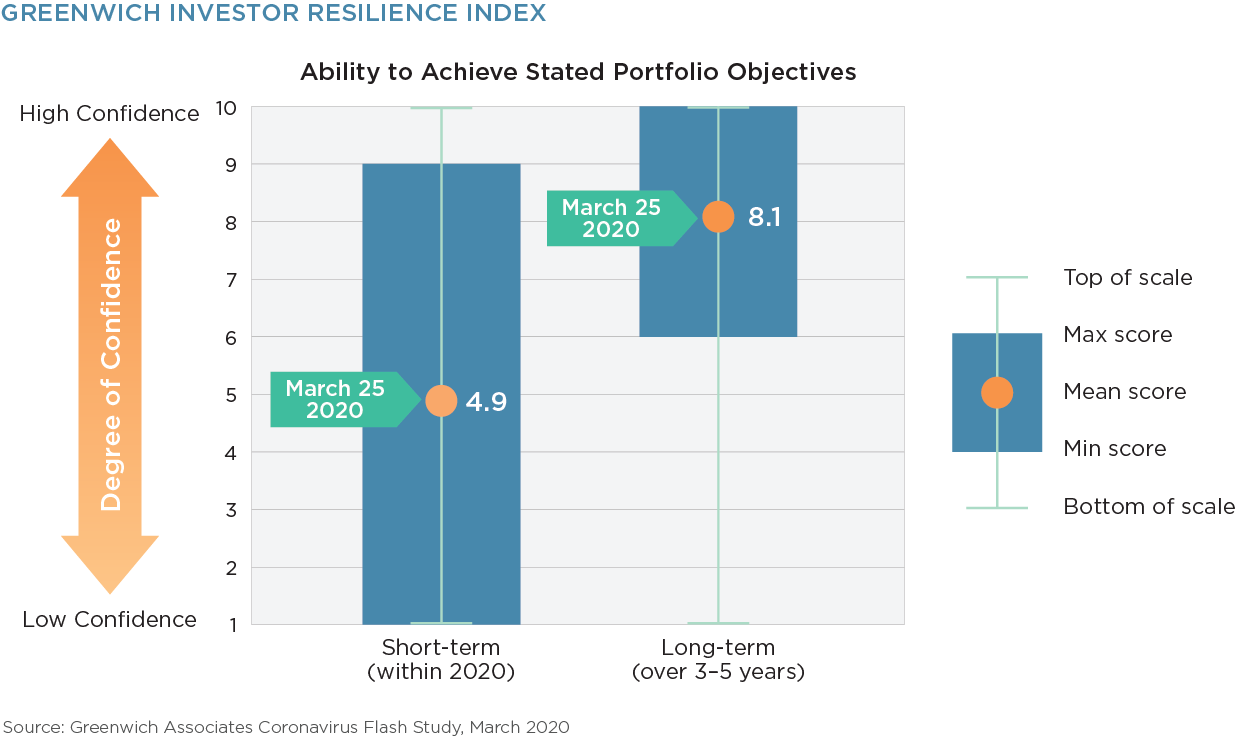

Greenwich Investor Resilience Index

Surely, there have been periods of extreme market volatility in the past—and, of course, other widely known and highly destructive global pandemics. However, what makes this shared experience different is the rapid arrival and immediate paralyzing effect it has had on people’s lives—both personally and professionally—and the fact that the volatility is not linked to systemic issues within the global financial system, as was the case with the 2008 financial crisis. Instead, uncertainty about what the future holds for markets, companies and people’s daily lives has led to a series of chaotic responses.

The good news for the asset management industry, at least so far, is that institutional investors seem to be retaining a positive long-term outlook, despite a high degree of distress about what the rest of 2020 will bring and how they will be able to react.

The Greenwich Investor Resilience Index shows that investors’ belief in their ability to achieve portfolio objectives within 2020 has already deteriorated dramatically. The short-term score is 4.9 on a 10-point confidence scale with responses ranging from 1 to 9, illustrating the uncertainty that currently exists among investors.

In contrast, investors do not yet worry that the coronavirus pandemic and its resulting social and economic fallout will have a meaningful impact on achieving goals over 3-5 years, with a long-term score of 8.1 on the same scale. With scores ranging from 6 to 10, confidence in long-term success appears to be shared.

Is this a naïve outlook? Will funding levels and short-term cash requirements cause institutional investors to make decisions that will ultimately make longer-term recovery significantly more challenging? Or will asset managers and consultants be able to step in and keep clients on the straight and narrow, reminding them that “this too shall pass” and providing short-term advice?

How Asset Managers Can Help Clients Through Crisis Events

Given the heightened level of volatility in the markets, institutional investors are scrambling to assess the impact to their portfolios, and they are turning to the asset managers with whom they work for support.

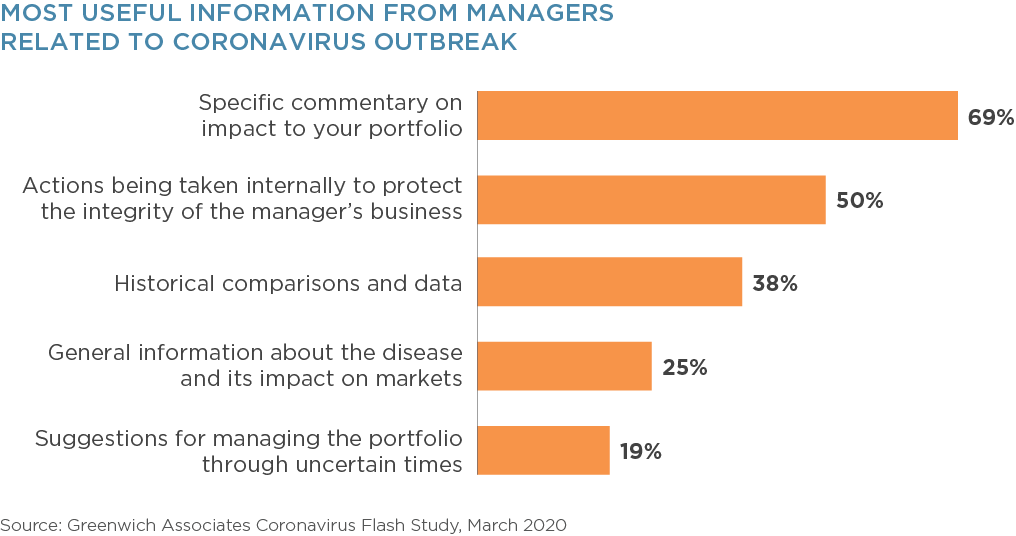

First and foremost, investors need to understand the impact of the crisis on specific investments. They want to understand what has happened and how the investment strategy is likely to perform going forward.

Second, they want to understand the actions their managers are taking to ensure business continuity in these challenging times. Managers should provide regular updates to clients about the steps they have taken to ensure business continues as usual now that employees and critical counterparties are frequently, if not exclusively, working from home and adjusting to a new virtual environment.

Third, investors are looking for perspective through historical comparisons and data. In uncertain times, investors seek insights on how markets should respond—and historical references can often provide clues.

Fourth, investors are seeking general information about the coronavirus and its impact on markets. Investment committees and boards are absorbing as much information as possible to assess whether pre-existing investment guidelines and principles remain reasonable and whether any short-term shifts are required. Managers that can utilize their macro research capabilities to provide data and commentary can help position themselves as strategic partners to these now vulnerable key decision makers.

Lastly, investors are seeking perspectives on broader portfolio-wide issues. Increasingly investors have been relying on their asset managers, in addition to their consultants, for advice and counsel. Managers with a broad range of capabilities should seek to position themselves as trusted partners—the goal, of course, is to be on investors’ speed dial rosters when issues arise.

Conclusion

Institutional investors are focused on long-term outcomes, and they are looking for their asset managers to provide them with support and guidance in these uncertain times. While performance is a critical component of the relationship, service and support have become increasingly important.

Managers that have implemented processes and procedures that allow them to respond rapidly to investors’ requests, thereby quelling anxiety, will position themselves to retain assets as investors seek to rebalance their portfolios. Further, managers that can provide impactful thought leadership and reliable advice, both in times of crisis and calm, will positon themselves to gain market share as assets consolidate over time.