Table of Contents

The novel coronavirus has caused an unprecedented shut down of global travel, trade and commerce. In our lifetime, we have never seen a virus cause such widespread fear, disruption to society or market uncertainty.

In response, the markets have tumbled into correction territory, and most experts are predicting a global recession on the horizon.

While this is entirely unwelcome news to both Main Street and Wall Street, a global recession is at least familiar territory. We’ve seen this movie before.

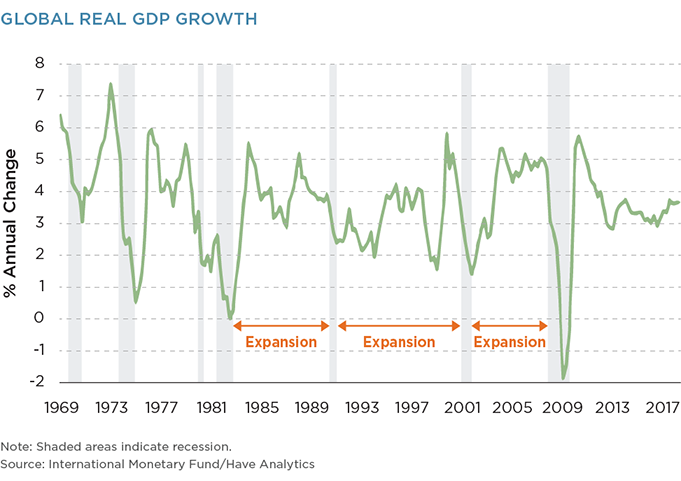

By most accounts, there have been six global recessions since 1970. We should be able to look to the past for ideas about what the future might hold. After all, “Those who cannot remember the past are condemned to repeat it.”

As long-term observers of the financial markets, in particular the asset management industry, Greenwich Associates maintains a great deal of historical data about investor sentiment and actions during previous market corrections and recessions. We are also privileged to have access to institutional investors working to navigate the current coronavirus crisis. Leveraging this access, we conducted a global ”pulse study” with large institutional investors the week of March 20, 2020.

Lessons from the Past

Market corrections are scary events for investors. However, institutional investors have proven to have greater fortitude and discipline in sticking to their investment strategy than retail investors during these periods.

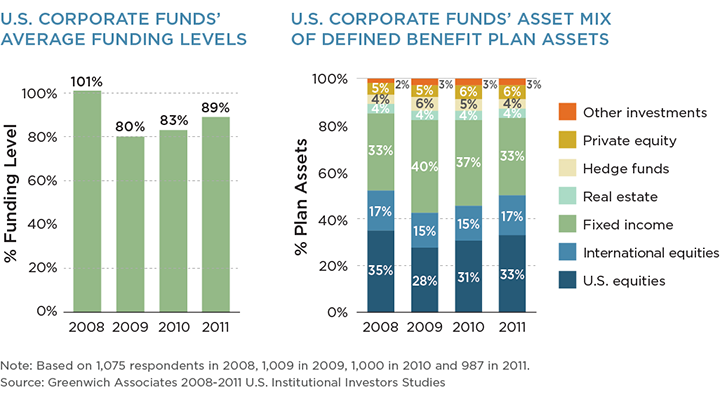

For example, average U.S. corporate pension funding ratios fell by 21% between 2008 and 2009, but investors largely reverted to target allocations by 2011. The same pattern is seen in other markets around the world. Asian institutional equity portfolios that fell from 25% in 2008 to 18% in 2009 (due to lower asset prices), returned to 26% by the end of 2011.

The takeaway: Recessions tend not to lead to a wholesale change in investment approach.

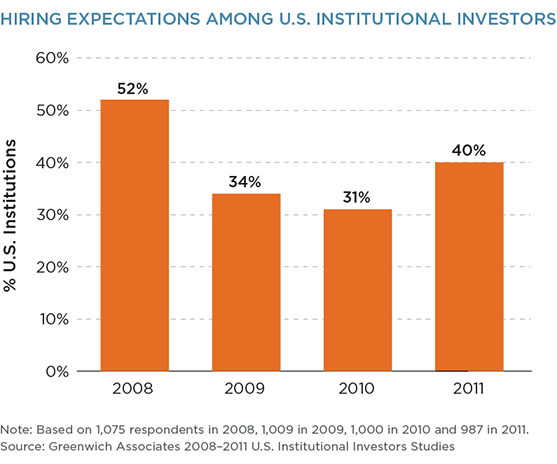

Further, history shows that institutional investors are patient and thoughtful (some might say “slow”) about transitioning managers that have underperformed during recessions. During the last recession, hiring/replacement levels slowed dramatically for 18 to 24 months until greater levels of certainty returned to the market and asset owners had greater clarity about manager performance and service delivery. Therefore, super-normal levels of communication and service are critical during market downturns.

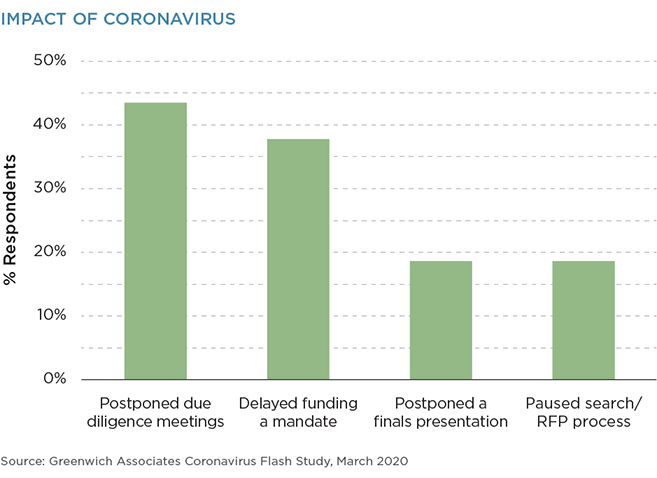

From a new business development standpoint, hiring opportunities will be precious in the coming 12 to 18 months. Based on our global pulse study, while some mandates may take longer to fund and hiring levels may slow, it does not appear as though investors are universally canceling manager search efforts as a result of the coronavirus pandemic.

What Keeps You Awake at Night?

As noted in Pandemic Perspectives – Part 1, institutional investors seem to be retaining a positive long-term outlook, despite a high degree of distress about what the rest of 2020 will bring. The Greenwich Investor Resiliency Index shows a short-term confidence score of 4.9 vs. an 8.1 score over the longer term.

Additionally, these investors voiced three key concerns about the “unknowns” related to the coronavirus pandemic:

Potential long-term impact on the economy: What if the optimists’ view that the economy will roar right back once the pandemic is under control does not play out? Instead, the coronavirus will have long-term economic impact and lead to a prolonged recession (think 1930s).

Enduring crisis of confidence: What if society loses confidence in a) our governments’ and policy makers’ ability to respond to future crises; b) the healthcare systems’ ability to protect us from future pandemics; or c) the U.S. dollar’s role as the reserve currency? This uneasiness may lead to instability in global political and economic systems.

Panic-driven investing as the norm: What if the coronavirus creates a new environment of uncertainty--about more than just health-related issues--that drives consistently higher levels of market volatility? This situation would make it more difficult for investors to achieve their long-term goals and objectives.

Although nobody (including us) has a crystal ball, managers would be wise to understand and address these concerns in discussions with clients and consultants in the weeks ahead.

Conclusion

We are all living through an unprecedented situation with the coronavirus pandemic. The economic outcome of the coronavirus (a global recession), however, is familiar territory. The managers that learn from the past by providing exceptional levels of communication, reliable advice and impactful thought leadership will be well positioned to succeed in the years ahead.

Part 1 – Greenwich Investor Resilience Index

Part 3 – Supporting Consultants During Coronavirus

Part 4 – Asset Manager Service Quality: Pre- and Post-COVID-19 Onset

Part 5 – Leading through Crises

Part 6 – Useful Content in Times of Crisis