Table of Contents

With no sign of abating globally, the impact of the coronavirus is testing the support that asset managers provide to investment consultants.

Asset managers’ service and support of consultants becomes all the more important during times of stress, as the stakes and requirements increase.

Against this backdrop, we engaged field consultants from leading investment consulting firms in the U.K., U.S. and Canada to get their perspectives and advice on how asset managers can best support consultants and their clients in the current environment.

Consultant Perceptions of Servicing and Support

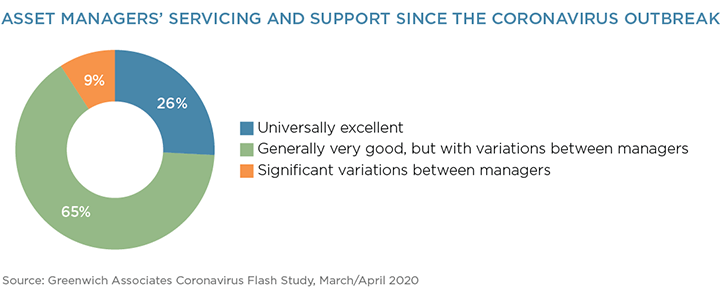

The good news is consultants’ perceptions of the service and support that they have received from asset managers since the coronavirus outbreak has been very good to excellent. Approximately one-quarter of respondents said the support has been universally excellent, with another two-thirds indicating it has been very good.

However, there is no room for complacency. Three-quarters of the consultants noted some variation in the support that they are receiving from asset managers, with a small percentage (9%) noting significant variation in asset manager support.

Given it has only been a period of weeks since the coronavirus fully affected global markets and elevated consultant servicing will be required for the foreseeable future, we expect greater variation in consultants’ perceptions of managers over time. The coming weeks and months will test asset managers’ responsiveness, communication, focus, and stamina.

Investment Consultant Expectations and Preferences

As asset managers work to maintain excellent relationships with consultants in the current environment, being aware of consultants’ preferences and expectations is critical.

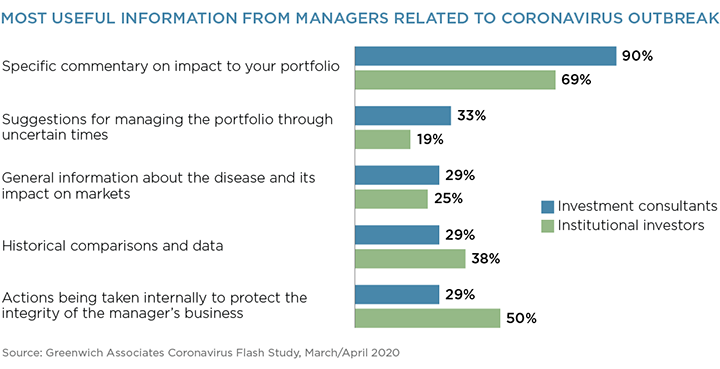

Consultants overwhelmingly name specific commentary on the impact of the coronavirus on clients’ portfolios as the most useful information they receive.

This has meaningful implications for asset managers with regard to the frequency and provision of attribution/client reporting.

Note also that consultants are less concerned than institutional investors about the actions that managers are taking to protect their businesses (i.e., business continuity); consultants tend to assess this factor more regularly and on an ongoing basis.

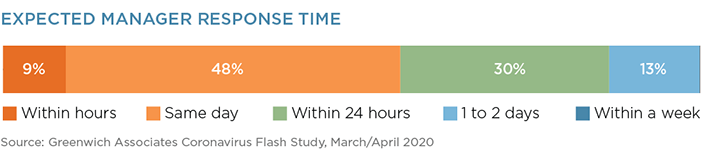

In terms of expected manager response times, 87% of the consultants said that they (and their clients) expect answers to their questions within 24 hours, with almost 60% indicating it should be the same day.

Excellence here requires that individuals across functions fully understand what is required to meet consultants’ expectations and are geared-up to play their part—this is about much more than just the consultant relations team.

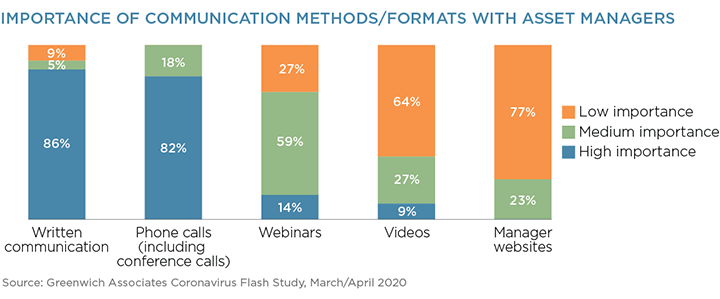

Given the consultants’ focus on their clients’ individual portfolios, written communication and phone calls (including conference calls) are their preferred methods/formats of delivery, with webinars the next most important.

Key Actions for Asset Managers to Take

Given an extended and indefinite period of heightened consultant engagement, we asked investment consultants for their advice on how managers could best support them and their clients. Three key themes, all interrelated, emerged.

Proactively Reach Out: Consultants expect asset managers to be accessible and very responsive, as noted above, but also proactive. Asset managers need to remain present and not ‘step back” or become internally focused.

“Many managers have provided a single update and they need to remember that as time goes on, so does the frequency of communication.”

Openly Discuss Portfolio Performance and Positioning: Consultants advise asset managers to be proactive, open and transparent about what has helped/hurt investment performance and to offer forward-looking thinking.

“Talk as openly as possible about how market conditions are affecting the portfolio and what they are doing about this.”

“Most clients appreciate a forthcoming discussion of what their losses look like and what their investment managers and consultants are doing about it. Thinking of ways to generate attractive go-forward, long-term returns is constructive and appreciated.”

Make Every Communication Count: Consultants are busy and many of their suggestions related to communication. While proactivity is required, balance is also needed, and consultant communication should focus on value-added information. Consultants advise managers to be selective, concise, consistent, and thoughtful in their communication.

“Quality is more important than quantity. Be thoughtful – don’t just spew out information every day – make every communication count.”

“Keep communications spaced and short and sweet. Everyone is overloaded with emails and webinars, so only push something if it obviously adds value.”

A carefully crafted and regularly updated consultant communication plan is required. Consultants recognize managers who get communication right and managers who do not.

Conclusion

The good news is that investment consultants’ perceptions of the support they’ve received from asset managers during the coronavirus outbreak have generally been very good to excellent. The important caveat here is that most consultants perceive variation in that support, and this will likely increase over time.

Consultants gave clear feedback and advice on what asset managers need to focus on in the current environment: being accessible and very responsive (24 hours); reaching out proactively; openly and transparently discussing portfolio performance, positioning and plans; and crafting and implementing a consultant communication plan that focuses on value-added information that is selective, concise, consistent and thoughtful.

Perceptions of asset managers who address these elements are much more likely to remain in the top echelon among the consultants they support.