Table of Contents

At its heart, asset management is a people business.

It is about analysts sharing investment theses with portfolio managers, service teams sharing insights with clients and distribution teams sharing ideas with prospects.

The industry is rooted in personal connections within organizations and with investors. The coronavirus has interrupted businesses around the world and made the process of maintaining these connections more challenging.

Asset managers have responded rapidly by shifting their organizations to remote work environments and finding ways to communicate internally and externally.

“Digital marketing and client engagement are a particular focus, and we believe having the processes and procedures in place to respond quickly to clients is vital.”

Transitioning to a Remote Work Environment

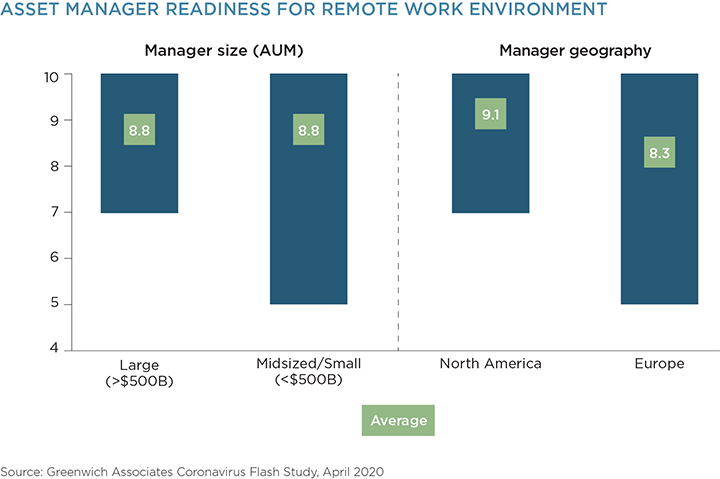

Based on our flash study with asset managers around the globe, most believe their organizations have handled this transition well, with managers providing an average score of 8.8 on a 10-point scale. Firms with robust emergency planning protocols established post-9/11 have experienced limited disruptions. Managers are leveraging various technology solutions to engage with clients and to host due diligence sessions.

“We are holding virtual meetings for short lists and client interactions, and these are going well and are easier to schedule than needing to book a full day of travel for those involved.”

Not all managers have had as easy a time, though, with midsize firms providing a wider range of responses and European managers reporting somewhat lower scores.

Technology has played an integral role in assisting with the migration to remote working, with the number of videoconferences expanding exponentially. For some managers, this has been a way to increase productivity, as travel has been all but eliminated. Many believe that the use of virtual meetings will increase post crisis.

“This period has made virtual venues much more credible to conduct important decisional/review meetings with investment committees.”

Keeping Up with the Joneses

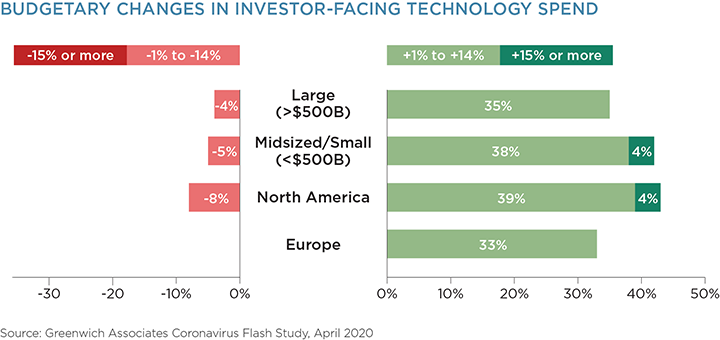

Driven in part by this crisis, over a third of the managers surveyed plan to increase their technology budgets in the future, with the largest increases expected by midsize firms and North American managers.

Large firms are better able to leverage their technology spend across a much bigger platform and, therefore, may be less inclined to increase spending than their smaller peers. In addition, the larger firms overall have managed well with the technology already in place and may not see a need to make additional investments.

Priming the Product Pipeline

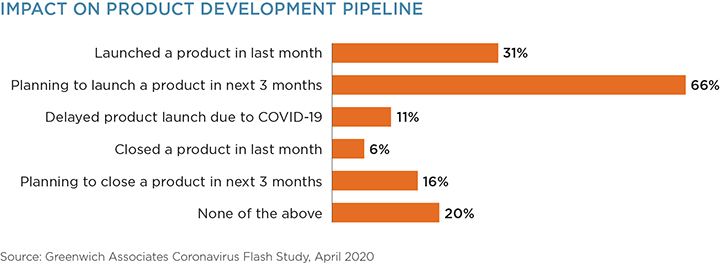

While the COVID-19 pandemic has shut businesses and forced many to shelter in place, it does not appear to have meaningfully affected asset managers’ product development activities.

More than 30% of firms launched a product in the last month and two-thirds are planning to launch a new product in the next three months. Only 11% of respondents reported having to delay a product launch due to COVID-19.

Managers are likely to have to increase the incubation time of these new products, as flows may be more challenged in the near term. While managers have worked to meet the needs of existing clients, new business is one area that will likely be affected.

“Prospect activity will likely suffer because it is harder to initiate relationships without an in-person meeting.”

Managing the Most Valuable Assets

Every week, the ranks of the unemployed continue to grow as businesses struggle to adapt to the new normal. Given the nature of the work and the ability to work remotely, the asset management industry has been spared some of this pain.

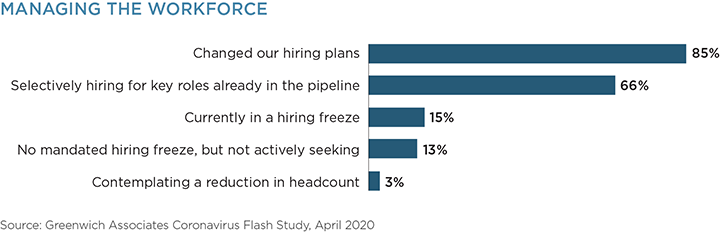

Hiring activity, however, has been impacted, with only 15% of managers citing that the crisis has had no effect on its employment plans while another 15% reported formal hiring freezes. Most managers are continuing searches for key positions and only 3% plan to reduce headcount.

Returning to the Old Normal

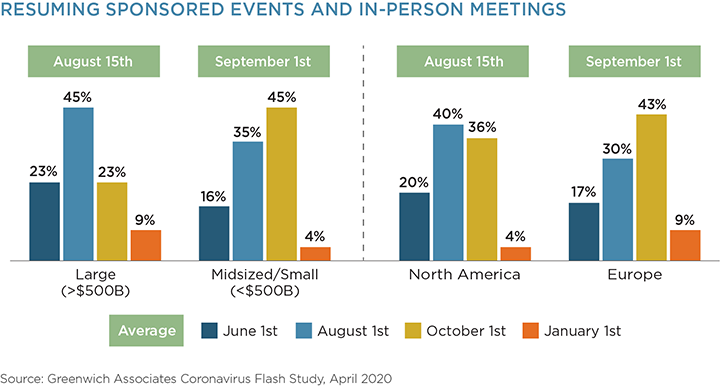

Asset managers have adapted to virtual meetings and events but are anxious to get back in front of clients and prospects. So, when are we getting back to hosting events and in-person meetings?

“At some point, given this is a relationship business, we hope to be able to get back to seeing clients in person.”

Managers plan to take the lead from clients, with the majority expecting to begin in-person interactions starting after the summer. The shift away from face-to-face meetings has forced managers to change the ways in which they communicate and will likely have a profound impact on the ways in which they interact with investors going forward.

“In person interactions are, of course, very valuable, and this will not go away. But the mix will shift, especially as the availability and comfort with virtual meetings as technology improves.”

Conclusion

“It’s the End of the World as We Know It (And I Feel Fine),” the song title from R.E.M.’s 1987 hit, sums up the sentiment among asset managers adjusting to the new normal. Most have migrated seamlessly to the remote work environment and have embraced the use of technology to communicate without the expense or hassle associated with travel.

While most managers believe that personal connections matter and that in-person events and meetings will resume in time, this crisis has forced managers and investors to engage in new ways of communicating that will likely have far-reaching implications for interactions going forward.