The growth of exchange-traded funds over the last 25 years has been one of the biggest secular trends in investing. Closely tied to the rise of passive investment management, ETFs allow investors to gain exposure to broad market indices such as the S&P 500 or individual sectors. In recent years, the types of products available have expanded in myriad ways, including ETFs with short exposure, leveraged exposure, style exposure, or ETFs that track different asset classes, countries, and regions—and now, actively managed ETFs.

ETFs have become an essential tool for institutional and retail investors alike. Financial advisors are heavy users of ETFs as they allow them to construct bespoke portfolios according to their client preferences and risk profile, or to provide smart beta exposure while the advisor layers on active bets. Institutional investors are also increasing exposure to ETFs, with allocations among U.S. institutions rising to 24.8%1 of total assets in 2018 and to 15% among European institutions2, according to recent Greenwich Associates research.

According to ETFGI, there are over 2,000 ETFs available in the United States and only slightly fewer in Europe. ETFs now represent up to 30% of average daily volume in U.S. equity markets and about 10% in Europe. These numbers are only set to increase in the U.S. with the new “ETF rule3” coming into force that seeks to reduce costs and time to market for ETF issuers.

With volumes at such record levels, ETF trading is becoming an important focus for both buy-side and sell-side desks. In this Greenwich Report, we look into the latest ETF execution trends among institutional equity trading desks.

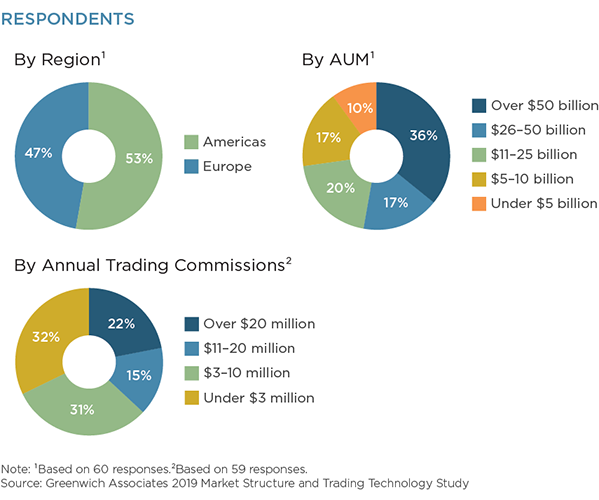

MethodologyBetween July and September 2019, Greenwich Associates interviewed 60 buy-side equity traders in the U.S. and Europe. Respondents were asked a series of questions about their usage and execution preferences for ETFs.