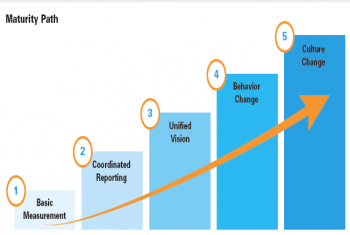

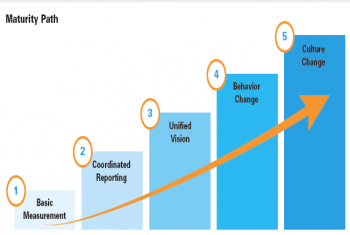

Enterprise feedback management platforms are emerging as powerful tools, but the task of selecting and implementing the right technology is only part of a much bigger and more complex strategic effort.

Enterprise feedback management platforms are emerging as powerful tools, but the task of selecting and implementing the right technology is only part of a much bigger and more complex strategic effort.

Given the current regulatory and market conditions, it's no surprise that everyone on both sides of the process is taking the broker vote more seriously than ever.

There is only one story in Canadian fixed income this year, and that story is BMO Capital Markets.

Trading volume was flat over the past 12 months.

Trading volume decreased 11% last year.

Trading volume increased 17% last year.

Trading volume decreased 41% last year.

Trading volume decreased 15% last year.

Trading volume increased 23% last year.

Trading volume decreased 25% last year.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder