2013 Global Interest Rate Derivatives - Market Trends Report - Continental Europe Top Tier

Trading volume in Interest Rate Derivatievs products increased across Continental Europe in 2013.

Trading volume in Interest Rate Derivatievs products increased across Continental Europe in 2013.

Trading volume in Interest Rate Derivatievs products increased across the Americas in 2013.

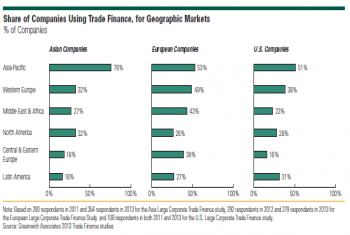

HSBC, Deutsche Bank and BNP Paribas are the leading providers in European corporate trade finance — a traditionally stable business that is now showing signs of some change.

Financial officers at mid-sized companies in Germany rate their banking service providers, and Greenwich Associates offers insight into how market share and quality leaders gained their edge.

With new capital rules forcing major banks to be judicious in deploying balance sheets for clients, large U.S. companies are often making credit provision a prerequisite when awarding capital markets, investment banking and other important mandates...

When it comes to flow equity derivatives, Goldman Sachs is the broker of choice for North American institutions...

Morgan Stanley is the flow equity derivatives broker of choice for European institutions...

German institutional investors are adjusting investment strategies and portfolio allocations in an attempt to generate yield amid low interest rates and declining return expectations. As they do so, they give top marks to Allianz Global Investors...

Bank of America Merrill Lynch’s 13.9% commission-weighted vote share in research and advisory services easily secures the firm the number-one spot in CEEMEA (including South African) equities for 2013. Deutsche Bank and Morgan Stanley are...

In this challenging environment, UBS and Credit Suisse captured the largest trading shares in European equities while UBS and Deutsche Bank are effectively...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder