Trading volume increased in 2013.

2013 Greenwich Leaders: Japanese Fixed Income

Amid a dramatic slowdown in institutional trading volume of Japanese government bonds (JGBs), Mizuho Securities and Mitsubishi UFJ Morgan Stanley Securities maintained their momentum as the market’s leading dealers.

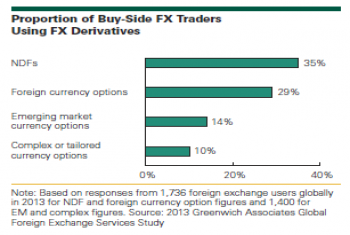

Regulatory-driven changes on the horizon will drive futures to become an important tool in foreign exchange traders’ toolbox.

2014 Transaction Cost Analysis Market Update - TCA Providers Make Strides in FX and Fixed Income

Fueled by regulatory and client demand, use of third-party TCA vendors now surpasses both proprietary and broker-provided tools among equity, FX and fixed-income traders alike.

At the top of this market is a group of three dealers including BMO Capital Markets, RBC Capital Markets and CIBC.

The Top 10 Market Structure Trends to Watch for 2014

Most swaps clearing members have been underpricing their offerings to gain market share since inception: This is about to end.

Trading Technology: OMS/EMS Trends, Rankings & Opportunities

The report examines 486 buy-side firms’ trading technology usage and spend, as well as their satisfaction ratings of major vendors.

This report provides detailed information on the institutional investment market across the United States.

This report provides detailed information on the institutional investment market across Canada.

2013 Canadian Institutional Investors Institutional Asset Allocation

Allocations to non-traditional products – namely real estate, infrastructure, and multi-asset class solutions – edged slightly higher in 2013.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Financial News: Banks' total markets revenue is expected to reach $259bn in 2025- the highest...December 10, 2025

-

S&P MI: Major U.S. and European banks are on course to book a total of $346 billion in revenue...December 9, 2025

-

The Desk: Retail Investors are leaning back into bonds, according to a recent Crisil Coalition...November 27, 2025