European Fixed Income: Market Structure Seeks New Foundation

Better-capitalized U.S. dealers are picking up a growing share of fixed-income trading volumes in Europe.

Better-capitalized U.S. dealers are picking up a growing share of fixed-income trading volumes in Europe.

Several countries showed strong gains in total compensation, of over 5%, including The Phillippines, Vietnam, Hong Kong and India.

Compensation was realtively flat over the past 12 months.

Compensation was realtively flat over the past 12 months.

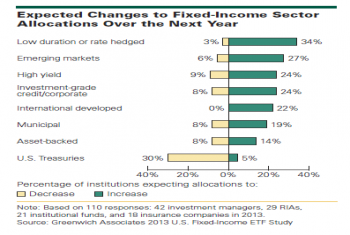

Fixed-income exchange-traded funds (ETFs) are poised to take on a bigger role in institutional portfolios.

New focus on retail structured products heightens competition among banks. J.P. Morgan leads in U.S. while Société Générale leads in Europe...

Electronic trading systems increased their share of global fixed-income trading volume in only slightly in 2013, bringing the proportion of total volume executed electronically to 25%. Top fixed-income e-trading platform players continue to...

OTC derivatives volume decreased in 2013.

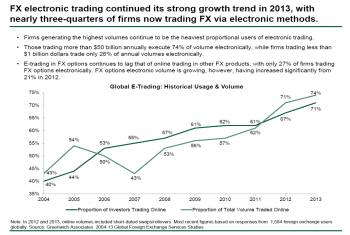

As strong growth continues in FX e-trading, regulatory changes and algorithm usage are driving some users back to single-dealer platforms.

The Asian equity market is attracting fierce competition from a large and diverse group of brokers looking to capture a share of the region’s recovering institutional research and trading business.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder