For the third year in a row, we can safely say the past year was like no other in the bond market.

For the third year in a row, we can safely say the past year was like no other in the bond market.

View which asset managers are top of mind for institutional investors in Asia across fixed income, equities and alternatives.

Review key industry trends focused on financial institutions for the institutional investors market in Japan.

Review key industry trends focused on endowments, foundations and pensions funds for the institutional investors market in Japan.

To say the institutional equities business is cutthroat would be an understatement at best, particularly for brokers competing in the electronic or algorithmic arena.

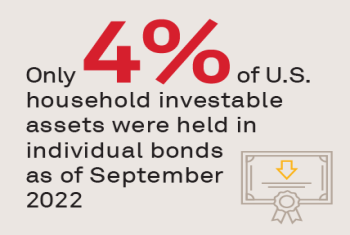

There are both macroeconomic and market structure reasons why retail investors haven’t held bonds over the past decade.

It’s official: As of Q4 2022, Libor is dead—with virtually all new loans and renewals in the final months of the year priced on SOFR or other alternative benchmarks.

The past year has been one of both transition and preparation, paving the way for 2023 to be a year of regulatory implementation and acceptance that current market conditions are the new baseline.

In 3Q22, Coalition Index Investment Banking revenue decreased by (16)% on a YoY basis.

While 2022 has been brutal for bond investors, the market’s volatility has proven to be a boon for traders.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder