Top Share of Mind Asset Managers for Institutional Investors – Continental Europe

View which asset managers are top of mind for institutional investors in continental Europe across fixed income, equities and alternatives.

View which asset managers are top of mind for institutional investors in continental Europe across fixed income, equities and alternatives.

Review the market position of leading investment consultancies in the United States employed by influential institutional investors.

Review the market position of leading investment consultancies in Canada employed by influential institutional investors.

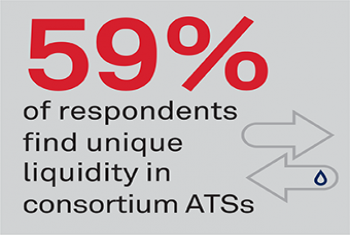

For volume executed away from the exchanges, in particular on the alternative trading systems (ATSs), one familiar question is whether liquidity or uniqueness is more important for a venue.

U.S. investment consultants have spent more than a decade expanding their relationships with institutional clients beyond their traditional realm of manager searches and into deeper strategic partnerships with investors. This report covers the 2020...

Learn about the impact of COVID-19 on businesses for corporates in Asia, top priorities for corporate treasury functions, top selection criteria for cash management providers, top digital experience banks, and more.

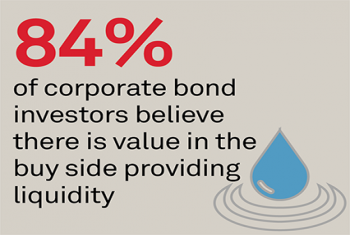

The incredible evolution of the corporate bond market over the past decade was moving forward at a swift pace as 2020 began. In March, the COVID-induced market panic began bringing with it (among other things) a huge test of corporate bond market...

March 2021 brought with it yet another record volume of electronic corporate bond trading with an average of $11.5 billion trading via platforms each day, beating the previous record set only two months prior by 8%.

While Treasury market activity remains well below its peak at the height of the panic, market activity and liquidity is quite healthy.

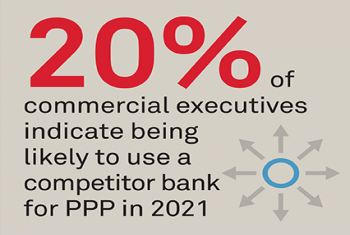

Record numbers of small businesses and midsize companies in the U.S. are considering switching banks due to what they saw as inconsistent support from their banks during the COVID-19 crisis. As commercial banks compete for this “money in motion,”...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder