Digital capabilities are now taking center stage, as corporates in India accelerate their use of electronic channels. Corporates are again likely to turn to their banking partners to fulfill their needs for innovative and agile trade finance...

Digital capabilities are now taking center stage, as corporates in India accelerate their use of electronic channels. Corporates are again likely to turn to their banking partners to fulfill their needs for innovative and agile trade finance...

Corporate bond markets during the COVID pandemic have seen record issuance, as corporations look to raise much-needed cash and U.S. Treasury markets act as the central tool of the U.S. government's fiscal stimulus plan.

The 2020 Greenwich CX Leaders recognize financial services leaders that have maintained customer relationships and delivered exceptional service during an unprecedented year.

Greenwich Associates closely examines the immediate and long-term effects the unprecedented year of 2020 will have on regtech going forward.

The most interesting element of October for electronic trading of corporate bonds was the sharp increase in Tradeweb volumes.

The disruption that is 2020 may have slowed some market participants' streaming efforts despite what feels like an inevitable evolution forward.

The COVID-19 crisis is accelerating innovation and spurring a new round of technology investments by wholesale banks. Banks’ effectiveness in targeting their IT spending will help separate winners from losers in the post-COVID marketplace.

This report provides detailed information on Asian trade finance, including insights from corporate treasury professionals on digital adoption during the COVID-19 crisis. Learn how banks supported corporates to alleviate their pain points related to...

On February 24, 2020, U.S. equity markets began a precipitous four-week decline, punctuated by a series of dramatic drops and rebounds.

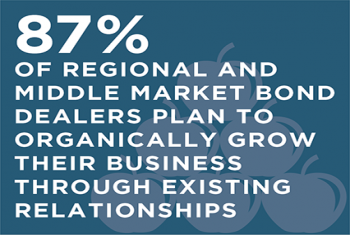

Historical highs and lows in the U.S. corporate and municipal bond markets punctuated all of 2020. The markets swung from record volumes and volatility in the spring to unnerving calm in the summer.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder