2022 has been an exceptional year for Markets activity, with revenues through the third quarter more than 5% above the previous peak of 2020. FICC has been the key driver of Markets outperformance, notching a 14% increase YoY.

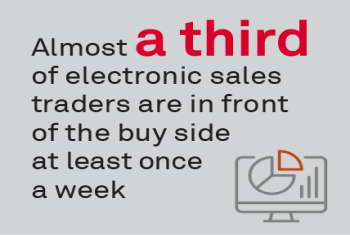

This study examines the individual views of U.S. electronic equity sales traders, algorithmic salespersons, equity trading heads, and equity market structure professionals—collectively, the sell-side electronic equity trading community—on a variety...

Fixed-Income TCA Adoption: What We Can Expect Going Forward

Data continues to be the driver and inhibiter of transaction cost analysis (TCA) adoption. While the majority of market participants we spoke with in a recent study are, in fact, incorporating cost analysis into their fixed-income investment...

Continental European Institutions Accelerate Move into Alternatives

The factors of high hiring rates combined with an expected expansion in allocations to alternatives are likely to further accelerate a shift in investment strategy and portfolio composition. The 2022 Greenwich Quality Leaders in Continental...

Wealth Management Firms Set Technology Priorities for 2023

The technology investments wealth management firms make today will play a big role in determining their ability to support financial advisors in their efforts to win clients and retain assets in the future.

The State of Play in Institutional Investors' Use of Private Credit

Driven by a combination of investor interest and companies’ need to seek alternative funding, global private credit grew more than six-fold since the Global Financial Crisis, surpassing $1.3 trillion in 2022. Faced with challenging macro conditions...

Digital asset years are like dog years. The changes in 2022 equate to nearly a decade of change in traditional markets.

Signs of Possible Competitive Shifts in Japanese Fixed Income

Japanese fixed-income investors may consider revisiting some long-established trading practices after the Bank of Japan took what could be the first small step toward unwinding its near decade-long policy of ultra-low interest rates.

To say the institutional equities business is cutthroat would be an understatement at best, particularly for brokers competing in the electronic or algorithmic arena.

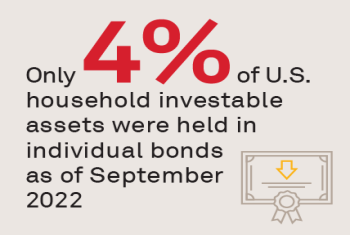

Understanding the Structure and Opportunity of Retail Bond Trading

There are both macroeconomic and market structure reasons why retail investors haven’t held bonds over the past decade.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Investment News: “Despite the boost the change in regulatory approach has provided to the industry...January 6, 2026

-

FT: Precious metals trading revenues at the top 12 global investment banks were about $1.4bn...December 24, 2025

-

Global Custodian: Eric Li, Head of Global Banking Research, Crisil Coalition Greenwich, shared his...December 24, 2025