The New Investor Segments: A Persona-Based Client Segmentation Model for Institutional Investment Managers

A game-changing, persona-based client segmentation model for the European institutional marketplace.

A game-changing, persona-based client segmentation model for the European institutional marketplace.

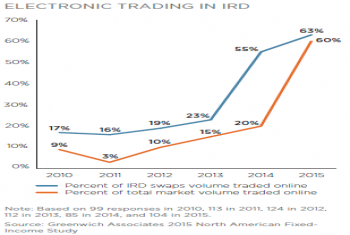

Despite 60% of IRD swaps trading electronically, U.S. investors still rely on their dealers' sales coverage.

Twenty five percent of U.S. small businesses and mid-sized companies are obtaining credit from non-bank providers.

The U.S. Treasury “flash crash” on October 15, 2014 acted as a catalyst for market structure change.

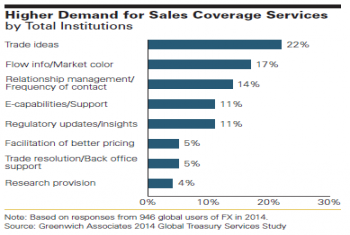

Despite the "electronification" of the FX market, buy side demand for direct contact with salespeople is on the rise.

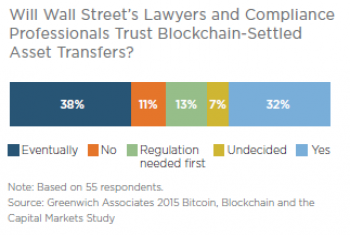

The technology behind Bitcoin is coming to Wall Street, but few agree how it will arrive or what exactly it will achieve.

The walls between etrading and high touch execution are crumbling.

A move to shared services offerings has come to capital markets, but reference data has yet to join the party.

Taking advantage of advanced methods on segmentation toward more holistic groupings can have substantial benefits to banks.

Amid all the time and resources asset managers devote to building “solutions-based” business models, the single most important factor in determining these firms’ success is the quality and execution of their relationship managers.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder