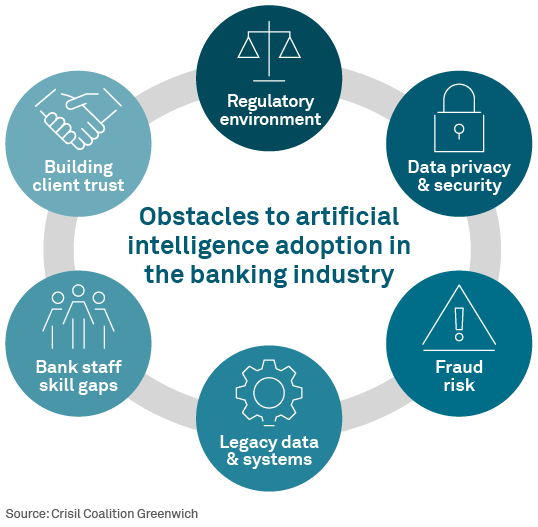

For banks, the process of adopting AI has been neither easy nor smooth. As mentioned in our prior blog post on artificial intelligence, corporate and commercial banks have deployed valuable AI use cases for some specific front-office applications. In many other areas, however, progress has been slow. For example, AI adoption has lagged significantly in the document-heavy Trade Finance business due to feasibility and regulatory hurdles. Those challenges are not unique to Trade. In fact, banks face significant challenges across the board.

The first among those challenges is data. For AI applications to work, they must have accurate, consistent and timely data. Banks’ internal systems are notoriously fragmented and complex. Banks are investing millions of dollars to knock down silos and otherwise modernize data management systems, but the industry has a long way to go to harness the full potential of AI.

As banks work to harness data to feed AI solutions, they are bumping up against new challenges in privacy, security, and regulation. Regulators in Europe, and at a slightly slower pace in the U.S., are working to construct regulatory frameworks for AI that would protect privacy, prevent discrimination, ensure safe and reliable AI models, and give consumers an option to opt out. These concerns are especially relevant in essential banking businesses like lending, in which regulators are closely scrutinizing the use of AI in credit decisions.

Banks also have natural incentives to move slowly with AI. Data security, fraud prevention and asset protection are non-negotiables for banks, and it’s understood that a single breakdown can undermine client trust and damage brands that have taken decades to build.

However, assembling development teams with the technical skills and industry understanding needed to create and implement safe AI applications can be difficult, especially when banks are competing against the tech industry for top talent.

Make no mistake: AI is transforming banking, and no bank can afford to sit back and wait to see how this all plays out. Despite the many challenges, banks must be moving proactively and even aggressively to determine how and where AI can be integrated into their businesses and workflows to develop internal pilots for testing and proof of concept, and to roll out real-life use cases through which AI begins to transform parts of their business.

Amos Welder, Relationship Director—Corporate Commercial Banking, and Kassie Krivo, Senior Relationship Manager—Corporate Banking, are the authors of this publication.