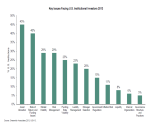

Nearly Three-Quarters of Global FX Volume is Electronic

March 25, 2014

Almost three quarters of global foreign exchange trading volumes (74%) were executed through electronic systems last year, up from 71% in 2012, according to a new report, As e-FX Market Matures, Incremental Growth Driven By Smaller Institutions, from Greenwich Associates that analyzes trends in non-interbank, client-generated FX trading volumes.