Table of Contents

The pandemic is proving to be a seismic event for the world economy. Although in most areas its impact on financial markets so far has been less severe than the 2008/9 financial crisis, its impact on the real economy based on measures such as unemployment has already been a lot more dramatic.

A key question, then, is whether institutional investors are looking to make fundamental changes to the broad trend in asset allocation strategies established over the past decade.

So far, the answer is “probably not” – but the crisis will accelerate the trend toward environmental, social and governance (ESG) investing, with much more emphasis on the social “S”, particularly outside North America.

Two main trends have been driving asset allocation strategies among institutional investors – de-risking of corporate defined pension plans and immunization of liabilities. Broadly speaking, this has reduced equity allocations and demand for liability-matching fixed-income instruments.

Outside the world of corporate defined benefit plans, the trend has mostly been toward higher risk assets in the form of specialty equity and fixed-income strategies and away from high-grade government bonds. Common to both groups, demand for private markets assets, such as private debt, private equity and infrastructure, has been rapidly rising.

Focus Remains on Long-Term Asset Allocation Plans Despite Crisis

Between January and April 2020, Greenwich Associates interviewed more than 500 institutional investors in continental Europe as part of its regular annual research cycle. The institutional investor population in continental Europe is highly diverse but broadly fits into the two aforementioned groups, with non-corporate defined benefit plans accounting for the majority of investors – i.e., public pension funds, defined contribution schemes, foundations, insurance companies, and other types of financial institutions.

Dividing the data collected into two cohorts – one from interviews conducted in January and February and one from those conducted in March and April – allows us to look at changes in future intentions for manager hiring and asset allocation.

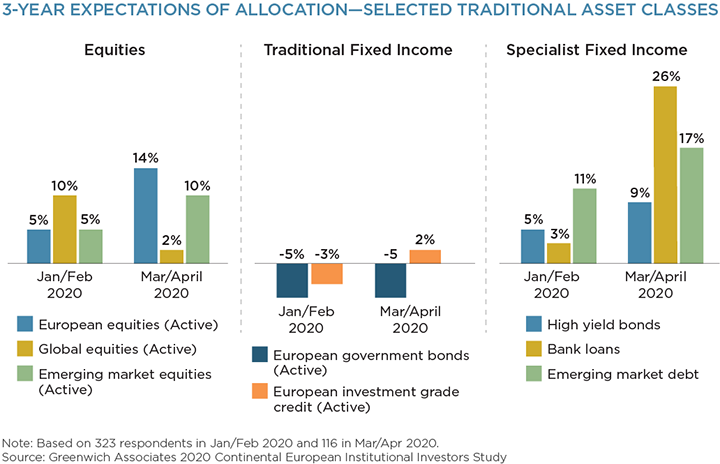

The charts below highlight that expected medium-term shifts in asset allocation pre-COVID and post-COVID do not show major changes. Investors are neutral or want to reduce high-grade fixed-income allocations and continue to want to increase exposure to both equities and specialty fixed income.

There is even an apparent shift toward more risk in March/April as illustrated by a higher share of investors intending to shift assets into European and emerging markets equities as opposed to global equities. Demand for bank loans is picking up amid significant dislocation in this asset class during the market turmoil.

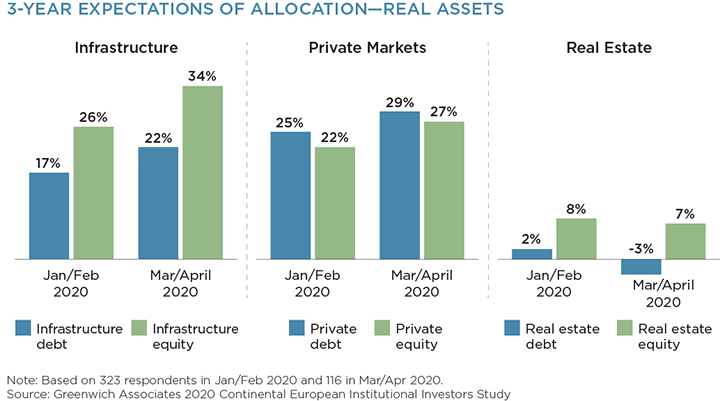

The story is similar in private markets where intentions to increase allocations to infrastructure debt and equity as well as to private debt and equity are remarkably resilient. These medium-term intentions are also reflected in near-term plans for hiring asset managers.

Short-Term Hiring Intentions Indicate Willingness to Capitalize on Market Dislocation

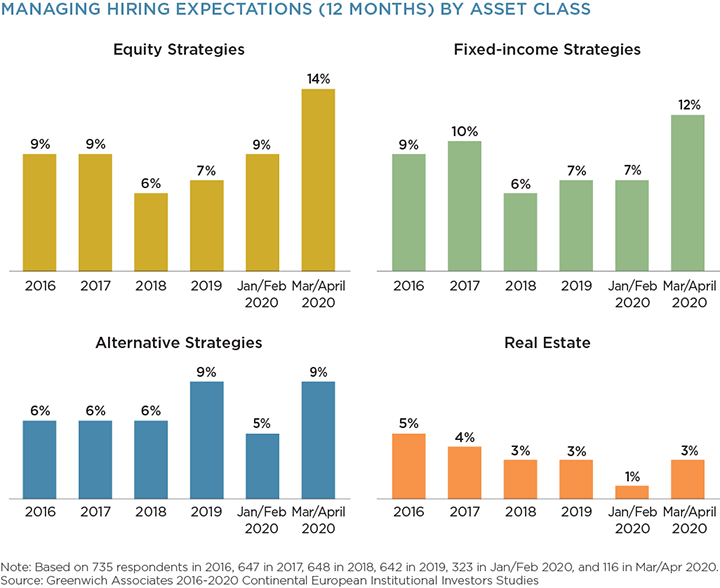

The share of institutions interviewed in March/April that are planning to hire a manager for equities and fixed income during the next 12 months has increased significantly from the trend line of the past few years.

The story is similar when it comes to alternative strategies, with real estate remaining the only asset class where demand looks unlikely to pick up. Investors will have to fundamentally reassess the long-term impact of the crisis on real estate subsectors such as hotels, retail and office before planning further increases in exposure.

While understanding the COVID crisis' impact on financial markets is still in its early days, investor reaction so far has been measured. Investors continue to focus on the long term when assessing whether the crisis could affect their overall investment strategies.

This is good news for the asset management industry, since the flow of new business does not look severely disrupted – albeit certainly delayed due to increased difficulty in arranging due diligence meetings or final presentations.

Acceleration of ESG Investing Outside North America

While asset allocation plans and hiring activity have not changed materially as a result of the COVID crisis, there is one area of investing where it is bringing a step change to an already strong trend – ESG investing.

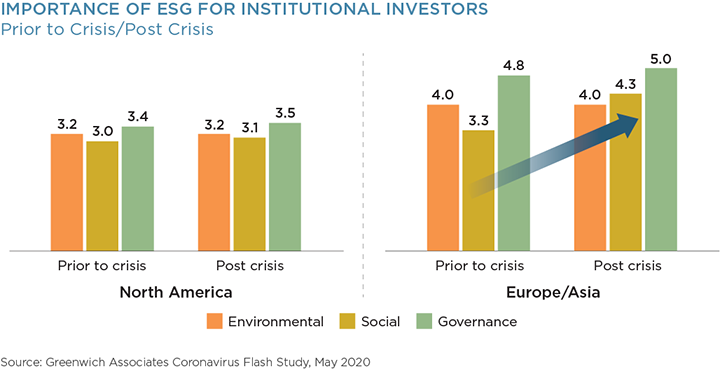

When respondents were asked to rate the overall importance of Environmental, Social and Governance factors to their investment approach, governance historically came out first, followed by environmental factors. Social factors have been ranking last.

Post-crisis, the importance attached to environmental and governance factors has not changed materially, but the social factor has gained significantly more weight – outside North America. The comment from one Asian investor sums up well how investors will look at companies’ role in managing the suffering and social challenges caused by the COVID crisis:

“The current crisis has a gigantic impact on the way people live. It gives a chance for corporates to show their will to help or improve social matters.”

This presents a challenge and an opportunity for the asset management community, since there is much less consensus on how to measure companies’ performance on social factors compared to environmental and governance factors. While there are accepted methods of measuring companies’ carbon footprint or voting on shareholder resolutions, this is much less clear for areas ranging from diversity and inclusion to ethically managed supply chains.

On the flipside, this change provides an opportunity for asset managers to develop more robust concepts on setting objectives and measurements for social performance and to further strengthen their ESG investment credentials.

Part 1 – Greenwich Investor Resilience Index

Part 2 – Lessons from the Past

Part 3 – Supporting Consultants During Coronavirus

Part 4 – Asset Manager Service Quality: Pre- and Post-COVID-19 Onset

Part 5 – Leading Through Crisis

Part 6 – Useful Content in Times of Crisis

Part 7 – Managers Adapting Through Crisis