Transaction cost analysis (TCA) is now an essential tool on most equity desks, where traders leverage it to help them understand trading performance, optimize routing, and to see how they stack up against their peers.

Transaction cost analysis (TCA) is now an essential tool on most equity desks, where traders leverage it to help them understand trading performance, optimize routing, and to see how they stack up against their peers.

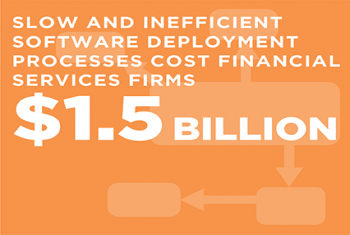

The current method for developing and deploying software within large financial services institutions has changed little over the last twenty years and is archaic when compared to the rapid innovation that is delivered seamlessly to our consumer-...

This report provides detailed information from corporates in the U.S. on current asset allocations in their investment portfolios.

Asian fund managers have been active in developing and distributing a large number of investment products, while fund distributors have become very selective in which products they actively promote with clients.

This report provides a comprehensive view on global equity commission rates. The report highlights trend across 7 different rate types in 77 different developed, emerging, and frontier markets.

After weathering the chaos of the financial crisis and the subsequent restructuring of the European banking industry, Europe’s largest companies are enjoying a welcome phase of stability in their banking relationships.

After nearly a decade of disruption and uncertainty, buy-side trading desks are finally finding a new equilibrium.

Compare salary and bonus versus those of peers by similar tenure and job function.

Compare salary and bonus versus those of peers by similar tenure and job function.

This report provides detailed information from institutional investors in Canada on managers used and products most in demand across equities, fixed income, alternatives, and specialty investments segmented by geography, type of investor and size of...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder