-

Most Helpful Traders and Analysts 2014 Asia Fixed Income Investors - Rankings

This report provides detailed information on the top performing Asian Fixed-Income traders and analysts.

Most Helpful Traders and Analysts 2014 European Fixed Income Investors - Asset-Backed Securities - Rankings

This report provides detailed information on the top performing Asset-Backed Securities traders and analysts in Europe.

Most Helpful Traders and Analysts 2014 European Fixed Income Investors - Emerging Markets - Rankings

This report provides detailed information on the top performing Emerging Markets traders and analysts in Europe.

Most Helpful Traders and Analysts 2014 European Fixed Income Investors - Rates - Rankings

This report provides detailed information on the top performing Rates traders and analysts in Europe.

Most Helpful Traders and Analysts 2014 European Fixed Income Investors - Credit - Rankings

This report provides detailed information on the top performing Credit traders and analysts in Europe.

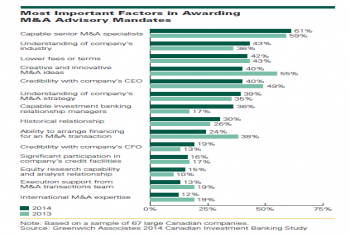

Canada’s biggest banks retained their tight grip on the mergers & acquisitions, equity capital markets and debt capital markets business of the country’s larger companies as of mid-year 2014.

U.S. Trade Finance Business Remains Concentrated with Top 5 Banks

Approximately 35% of large U.S. companies do business with Bank of America Merrill Lynch, Citi and J.P. Morgan.

By outsourcing technology, buy-side firms can save money better spent to lower fees, lower risk and increase alpha.

2014 Fixed Income Investors - Europe Investment-Grade Credit - Rankings

Trading volume decreased significantly last year.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Financial News: Banks' total markets revenue is expected to reach $259bn in 2025- the highest...December 10, 2025

-

S&P MI: Major U.S. and European banks are on course to book a total of $346 billion in revenue...December 9, 2025

-

The Desk: Retail Investors are leaning back into bonds, according to a recent Crisil Coalition...November 27, 2025