U.S. companies’ usage of trade finance has increased in every major foreign market, suggesting that big companies here are putting international expansion plans into motion.

The Rollercoaster Continues, Greenwich Leaders Stay the Course

“Brokers dominating in emerging markets equities share three characteristics,” says Greenwich Associates consultant John Colon. “They have proven their commitment this business, they have developed specific expertise at the sector...

Although on the surface things seem relatively placid in the European equity industry, with broker commission payments leveling off in 2014 after an extended period of weakness, the European brokerage business could be on the verge of the biggest...

Best Practices in Institutional Distribution

Greenwich Associates has assembled 24 best practices across sales, consultant relations, and relationship management based on our strategic consulting work with leading asset managers around the globe.

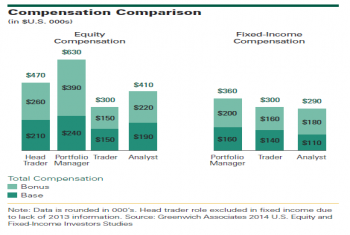

After years of playing second fiddle to the sell side as a career option, the asset management industry is emerging as the first choice for many financial professionals.

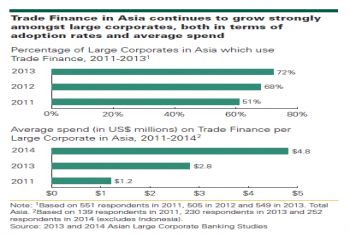

Across Asia Corporates Use of Trade Finance Increases

Following a period of de-concentration in the competitive landscape of trade finance providers in Asia, the leading providers on average lost a few points of market penetration, as a long tail of local and emerging regional banks picked up...

2014 Fixed Income Investors - Europe High-Yield Credit - Rankings

Trading volume increased last year.

2014 Japanese Institutional Investors - Asset Allocation - Graphics

Examining the gap between actual and target allocations, we anticipate continued rebalancing pressure on domestic equities, active and passive, while gains are expected for active international equities.

2014 Japanese Institutional Investors - Product Demand - Graphics

Anticipation of hiring activity for Corporate/Credit and Inflation Linked fixed income managers is stronger than the previous year indicating changes in the investing environment.

2014 Japanese Institutional Investors - Market Characteristics - Graphics

Defined benefit plans’ funding ratios continue to improve in 2014. Over 54% of fund sponsors, (compared to 41% in 2013), are now reporting funding ratios exceeding 90%.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Financial News: Banks' total markets revenue is expected to reach $259bn in 2025- the highest...December 10, 2025

-

S&P MI: Major U.S. and European banks are on course to book a total of $346 billion in revenue...December 9, 2025

-

The Desk: Retail Investors are leaning back into bonds, according to a recent Crisil Coalition...November 27, 2025