Trading volume increased last year.

Trading volume increased last year.

Trading volume decreased last year.

Trading volume in Agency Securities increased last year.

Trading volume decreased significantly last year.

Trading volume increased significantly last year.

Trading volume in Asset-Backed Securities increased last year.

Trading volume decreased last year.

Equity derivatives remain essential tools for institutional investors, but the lack of volatility in global markets has reduced trading volumes.

In Asia and Europe, market fragmentation continues to be relatively high while the top 5 banks in the U.S. are (re)gaining penetration, approaching 50% at the expense of smaller players.

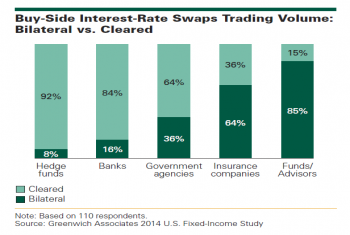

Although the U.S. swaps market has been radically transformed, market participants are still evaluating trading on swap execution facilities (SEFs) and how they may adapt their derivatives trading operations to comply with new regulation.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder