After a quiet April, the U.S. corporate bond market perked back up in May with just over $40 billion notional traded per day – a 3% rise from May of 2022 and 9% higher than the month before.

After a quiet April, the U.S. corporate bond market perked back up in May with just over $40 billion notional traded per day – a 3% rise from May of 2022 and 9% higher than the month before.

Global bond markets have experienced a dramatic adoption of electronic trading tools over the past decade, led largely by developed markets in the U.S. and Europe.

Coalition Greenwich, in a collaboration with SIX Group, interviewed 79 global buy-side and sell-side firms to confirm what drives their choice of market data vendor, what types and frequency of data these firms are buying and consuming, and their...

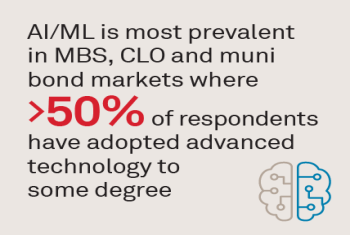

Artificial intelligence (AI) and machine learning (ML) have been buzzing for some time.

This report provides detailed information from Canada-based fixed income investors.

The “Money-in-Motion” analysis offers a forward-looking view on potential mandates, flows and revenues that are up for grabs due to manager hiring activity among institutions. It is based on the reported hiring expectations of investors across a...

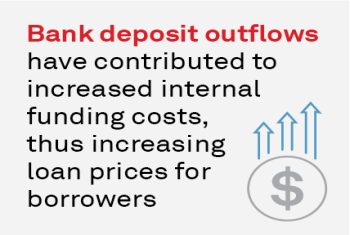

Although the U.S. banking industry has at least until now avoided a much-feared run on small banks, steady deposit outflows are increasing funding costs for banks of all sizes and driving up the price of commercial loans.

MiFID II is an updated version of the Markets in Financial Instruments Directive (MiFID), a set of rules and regulations that govern the financial markets in the European Union (EU).

This report provides detailed information from EMEA-based financials foreign exchange users.

This report provides detailed information from U.S.-based financials foreign exchange users.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder