In the most comprehensive study to date, Greenwich Associates assesses the current state of blockchain adoption across banks, brokers, asset managers, exchanges, and technology vendors while also capturing the opinion of the leading blockchain...

In the most comprehensive study to date, Greenwich Associates assesses the current state of blockchain adoption across banks, brokers, asset managers, exchanges, and technology vendors while also capturing the opinion of the leading blockchain...

There are signs that a fundamental shift may be afoot, most notably in the traditional alignment between sell-side firms’ standing in research with their standing in trading.

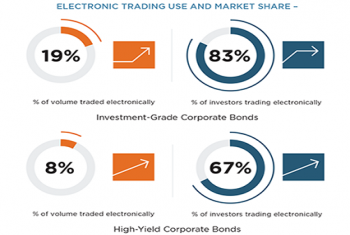

The story of electronic trading growth in the corporate bond market continues. Over 80% of U.S.-based credit investors now transact investment-grade corporate bond trades electronically...

Greenwich Associates has tracked the share of trading commissions captured by bulge-bracket firms, mid-sized or regional brokers and “execution-only” firms. The trend is readily apparent, as bulge-bracket firms face increasingly stiff challenges...

In banking, the iterative approach that is the hallmark of agile enables faster development of and improvement to digital banking platforms in response to customer demand.

Many observers estimate that IEX's new exchange status, strong positive brand and protected quotes will allow it to climb the ranks and garner a market share of around 5 - 6%.

Anyone operating in the U.S. equity market knows it is challenging times. The continued pressure on commissions remains the main story for the buy side, sell side and technology providers operating in the space.

It is easy to focus on the bells and whistles of the feature sets, however the ROI from these outlays can be difficult to quantify, particularly for “user experience” factors such as ease of use.

In the most comprehensive study to date, Greenwich Associates assesses the current state of blockchain adoption across banks, brokers, asset managers, exchanges, and technology vendors while also capturing the opinion of the leading blockchain...

2015 was a record-breaking year for ETFs, which attracted more than $350 billion in new assets globally.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder