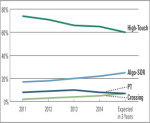

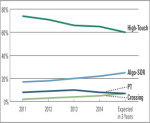

Institutions in Asia are executing a steadily increasing proportion of business on a low-touch basis (algorithms, DMA, crossing, portfolio trades) as opposed to traditional high-touch business executed through a broker sales trader. These same...

Institutions in Asia are executing a steadily increasing proportion of business on a low-touch basis (algorithms, DMA, crossing, portfolio trades) as opposed to traditional high-touch business executed through a broker sales trader. These same...

The European Commission, ESMA and the FCA appear to be including fixed income in new payment for research requirements in MiFID II and EMiR by not explicitly excluding fixed income research. The question is whether a service can be viewed as an...

We might be getting a little bit closer to understanding whether or not the changes in the capital markets are cyclical or structural. We view volatility - or the lack thereof - as a major factor impacting profitability across financial...

Market structure happenings have been fast and furious since 2009, and 2014 did not disappoint. Mandatory SEF trading finally began, fixed income electronic trading continued its steady incline, the current shape of the US equity market was...

Another year down. We're a year further from the Lehman bankruptcy, a year further from the signing of Dodd-Frank and a year closer to the full implementation of Basel III. But before we start looking ahead, let's look back at the year in market...

I’m not a great fan of regulation for regulation’s sake. While this is too strong and cursory a judgment on what has been happening in the US and Europe for the past few years, some suggested regulatory changes make you wonder. For instance,...

Sales trader relevance has been debated for more than a decade as buy-side driven execution algorithms and trading tools have made self-service trading ubiquitous. Despite the ability of institutional investors to trade via cheaper self-directed...

Greenwich Associates (and I) have for the most part stayed out of the recent high frequency trading debate. Thankfully the discussion has gone (somewhat) beyond whether HFT is good or bad and has moved towards a broader debate around the best market...

We've just released the results of our benchmark US equities study, based on almost 600 interviews with US equity investors. While Greenwich has been conducting this study for literally decades, this is my first market structure analysis...

Over the past decade or so, the growth of OMS and EMS platforms has paralleled the growth of electronic trading – but it would be a stretch to suggest a direct cause-and-effect relationship. These days, though, given the growing importance of...

We are always here to help you