More than 88% of U.S. active large-cap funds underperformed the S&P 500 over the last five years. In Europe and Japan, 74% of active large-cap funds underperformed similar index benchmarks...

Alternative data is becoming a coveted tool for institutional investors seeking alpha. But as many on the buy side can attest, turning a seemingly endless array of data into something...

The results of Greenwich Associates 2016 Global Exchange-Traded Funds Study reveal that institutional investment in exchange-traded funds is growing, as new users introduce ETFs into their...

Executive Summary

Greenwich Associates research reveals that approximately 70% of an investor’s perception of an asset manager is linked to investment performance. Without competitive investment...

Recognizing the influence back-office issues have on the bank customer experience requires a change in thinking. In addition to focusing on “customer-facing” employees, banks should also identify “...

Today, wealth management represents a key growth driver for commercial banks and other financial institutions. However, most of them are falling short of their potential when it comes to winning...

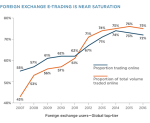

The foreign-exchange market remains the most electronically traded market in the world. Of the total notional volume traded by institutional investors globally, 75% is now traded on the screen, up...

Based on interviews with 46 bond dealers in the U.S. and Europe, this study examines the differences in how bulge bracket and regional dealers are adapting to the post-crisis market structure. The...

Since 2009, U.S. equities have been on a tear, with the S&P 500 increasing by 3.5 times. Against this backdrop, one might expect U.S. brokers to have benefited handsomely from the equity bull...

In 2015 Greenwich Associates research found that the top five FX dealers, while still dominant, were ceding market share to regional and smaller firms. This shift was driven predominantly by top-...