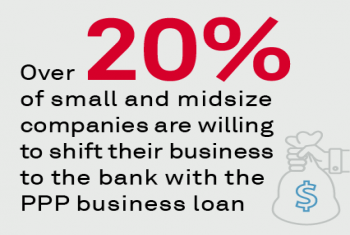

Trade finance may have been a latecomer to the digitalization party, but its growing adoption, along with companies’ increased thrust on improving environmental, social and governance (ESG) compliance, presents a real opportunity for banks in Europe...