2015 Fixed Income Investors - Europe Emerging Markets - Rankings

This is how the dealers position in Emerging Markets this year.

This is how the dealers position in Emerging Markets this year.

Firms concentrate over 70% of options and volatility product business with their top 3 dealers.

Nomura Securities dominates both cash equity trading and research/advisory services.

The 2015 key market trends for Latin American trade finance broken down by sales size, company type and industry group.

The 2015 key market trends for Canadian trade finance broken down by sales size, company type and industry group.

The 2015 key market trends for Canadian cash management broken down by sales size, company type and industry group.

The 2015 key market trends for cash management in the United States broken down by sales size, company type and industry group.

The 2015 key market trends for corporate banking in the United States broken down by sales size, company type and industry group.

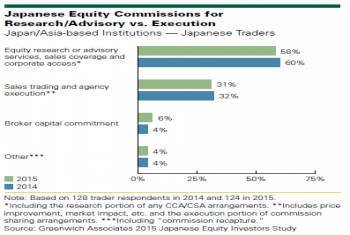

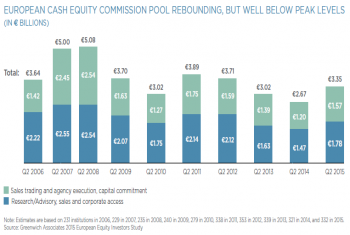

In an unbundled world, the cost of execution may go up to the extent the real cost of liquidity has been obscured by bundling.

Total compensation for Convertibles traders increased last year.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder