2015 United States Institutional Investors - U.S. Fixed Income Competitive Positioning

Pimco and Blackrock hold a significant market position in U.S. fixed income management.

Pimco and Blackrock hold a significant market position in U.S. fixed income management.

Canadian institutions rank as some of the most active and sophisticated ETF investors in the institutional marketplace.

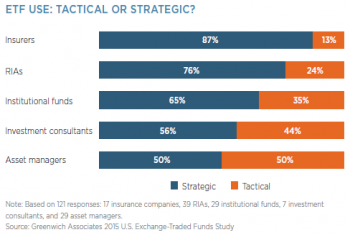

The growth in institutional investment in exchange-traded funds (ETFs) can be attributed to a single factor, versatility.

While gold has been a store of wealth for thousands of years, it received renewed attention following the financial crisis, as confidence in the banking system was shaken.

Total notional volumes for retail structured products distributed by U.S. firms remain at over $54 billion annually.

Electronic trading has changed the entire capital markets landscape. But the interest-rate derivatives (IRD) market has shown that despite quantifiable benefits of e-trading, institutional investors would still prefer to interact with...

A dearth of client trading activity in Japanese government bonds has triggered a push by the country’s largest domestic fixed-income dealers into non-yen products, particularly non-yen government bonds.

Insights from Greenwich Associates' 2015 Large Corporate Finance Study, includes Corporate Treasury Compensation information, market trends and top issues facing U.S. Corporate Treasuries.

Market Trend data from Greenwich Associates' 2015 Total United States Debt Capital Markets study.

Market Trend data from Greenwich Associates' 2015 Total Canada Large Corporate Trade Finance study.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder