2015 German Institutional Investors - Manager and Product Demand - Graphics

Use of diversified fixed income to drive return has continued to strengthen at the expense of traditional allocations; alternatives hiring expectations are strong.

Use of diversified fixed income to drive return has continued to strengthen at the expense of traditional allocations; alternatives hiring expectations are strong.

Fixed income allocations contract marginally as investors begin deploying assets elsewhere in search of growth.

Blended default funds remains the dominant option among DC schemes.

Consultant intermediation slips slightly among corporates as third party advisors increase their presence in the marketplace.

Manager hiring expectations collapse and activity is expected to be skewed firmly towards larger plans.

Overall equity allocations drop to a record low, but active international equity allocations has increased driven by strong market performance; total LDI allocations are significant at 15%.

Corporate DB funding levels slip as bond yields fall back; local authority funding levels remain stubbornly low.

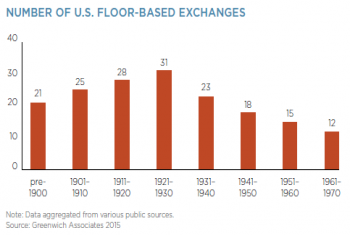

An examination of U.S. market structure shows an industry that is still coming to terms with the effects of its short courtship and hasty marriage with technology.

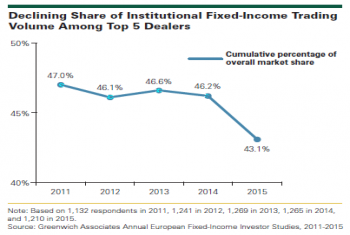

The competitive positioning of Europe’s leading fixed-income dealers is increasingly defined by regulations and banks’ strategic responses to new rules that have altered the economics of the business.

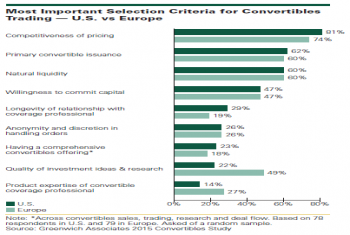

Brokers globally are battling for potentially lucrative trading business in options & volatility products, equity swaps, equity futures, and convertibles compete on the basis of pricing, willingness to commit capital to trades, their own...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder