Greenwich Associates consultant, Lydia Vitalis, discusses how the asset management industry is promoting diversity.

Greenwich Associates consultant, Rodger Smith, discusses transformational change in the asset management business.

Greenwich Associates consultant, Abhi Shroff, discusses new frontiers institutional asset management, focusing on the emerging Asian market.

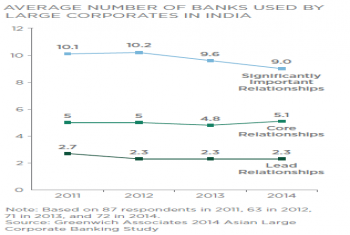

Large Corporate Banking: India - Local Banks on the Rise

Domestic banks in India have been closing the qulaity gap and winning key spots on Indian large corporates' bank lists.

The New Investor Segments: A Persona-Based Client Segmentation Model for Institutional Investment Managers

A game-changing, persona-based client segmentation model for the European institutional marketplace.

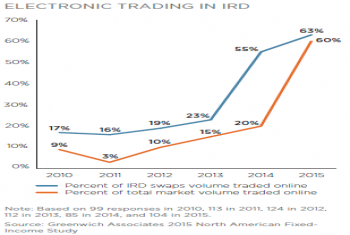

Interest-Rate Derivatives Sales: Not What It Used To Be, But No Less Important

Despite 60% of IRD swaps trading electronically, U.S. investors still rely on their dealers' sales coverage.

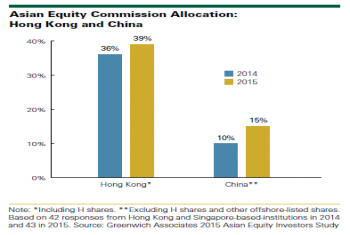

Fierce competition for trading share among Asian equity brokers.

Total compensation for Equity Derivatives traders decreased last year.

Total compensation for Equity Derivatives traders decreased last year.

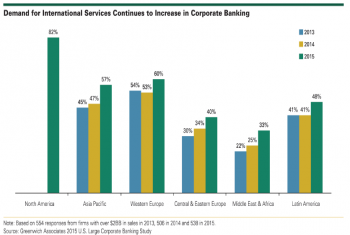

New Regulation Benefits the Top Banks with Larger Share

U.S. corporates increase concentration of banking business in the hands of the market’s biggest banks.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Financial News: Banks' total markets revenue is expected to reach $259bn in 2025- the highest...December 10, 2025

-

S&P MI: Major U.S. and European banks are on course to book a total of $346 billion in revenue...December 9, 2025

-

The Desk: Retail Investors are leaning back into bonds, according to a recent Crisil Coalition...November 27, 2025