To say the institutional equities business is cutthroat would be an understatement at best, particularly for brokers competing in the electronic or algorithmic arena.

To say the institutional equities business is cutthroat would be an understatement at best, particularly for brokers competing in the electronic or algorithmic arena.

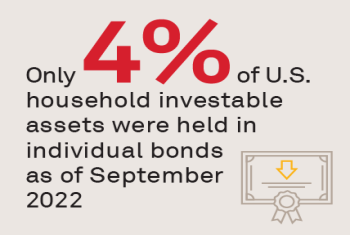

There are both macroeconomic and market structure reasons why retail investors haven’t held bonds over the past decade.

It’s official: As of Q4 2022, Libor is dead—with virtually all new loans and renewals in the final months of the year priced on SOFR or other alternative benchmarks.

The past year has been one of both transition and preparation, paving the way for 2023 to be a year of regulatory implementation and acceptance that current market conditions are the new baseline.

In 3Q22, Coalition Index Investment Banking revenue decreased by (16)% on a YoY basis.

While 2022 has been brutal for bond investors, the market’s volatility has proven to be a boon for traders.

After the big flurry of activity late in October following the Federal Open Market Committee (FOMC) meeting, U.S. Treasury markets in November showed signs of calming heading toward year end.

One can only describe the recent market volatility and business failures in digital assets as troubling. Despite the volatility, however, Coalition Greenwich sees sustained or increasing interest in this asset class among investors served by...

With dozens and dozens of managers to choose from, successful investment managers will be those who develop differentiated value propositions that stand out from the crowd.

While ESG is a prominent term, it is not a precise term. Some view ESG as a risk management technique; others as a way to generate positive impacts.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder