2021 Key Trends in the Canadian Institutional Investment Consulting Business

Review the market position of leading investment consultancies in Canada employed by influential institutional investors.

Review the market position of leading investment consultancies in Canada employed by influential institutional investors.

FY21 Coalition Index Investment Banking revenues were up by 8% on a YoY basis.

Amid continued disruptions from the COVID-19 crisis and concerns about mounting inflation, U.S. asset owners leaned more heavily on the advice of their investment consultants last year. The 2021 Greenwich Quality Leaders in U.S. Investment...

Derivatives clearing has experienced a consistent growth trend for more than a decade. While buy-side adoption of clearing was originally driven by new regulations following the global financial crisis, the growth of clearing in the past few years...

It feels like all we write about lately is volatility, but it’s hard not to. The MOVE Index ended March up 22% from the February average and up 68% from March of 2021.

Corporate bond market activity growth over the past 10 years is nothing short of remarkable. And while market activity in 2022 is so far lagging 2021, we very well could be on our way to the busiest year ever for secondary market U.S. corporate bond...

U.S. Commercial Banking contributed steadily to the overall industry revenue pool up until FY19 but from the beginning of 2020 there has been a continuous decline in share.

Tokenization allows traditional capital markets participants to harness the benefits of blockchain technology—such as an immutable ledger of ownership, transaction history and rapid settlement.

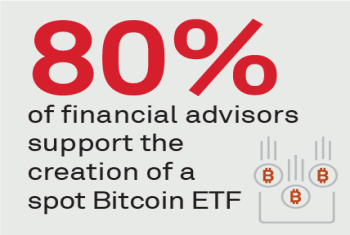

Recent Coalition Greenwich research found that two-thirds of financial advisors in the U.S. had discussed crypto and/or digital assets with their customers in the past year, but for the vast majority of advisors those discussions have not led to...

In late September 2020, the U.S. Securities and Exchange Commission (SEC) adopted amendments to modernize Exchange Act Rule 15c2-11.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder