Greenwich Commercial Lending Market Insight - Q4 2021

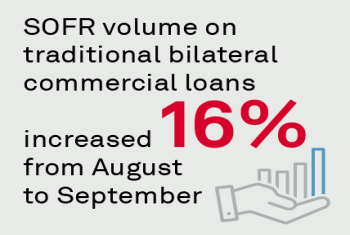

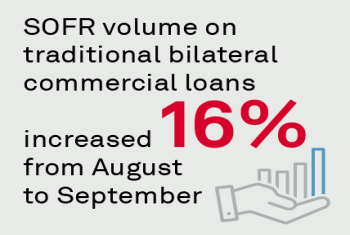

The year-end mandate to cease Libor-based lending is fast approaching.

The year-end mandate to cease Libor-based lending is fast approaching.

Companies around the world are introducing ESG and sustainability goals into corporate finance and treasury functions. As they do, corporate banks have a valuable opportunity to deepen client relationships and win new business by helping companies...

As cryptocurrency moves from a largely retail product at the edges of the market place to a product that engages a broad set of institutional investors across the financial markets, impediments to wider use will have to be solved.

The pandemic-led market events created tremendous opportunity for financial advisors by accelerating the pace of change.

Commercial banks have an opportunity to strengthen client relationships by providing advice and support to small businesses and middle-market companies concerned about inflation, supply-chain disruptions and other threats to the economy.

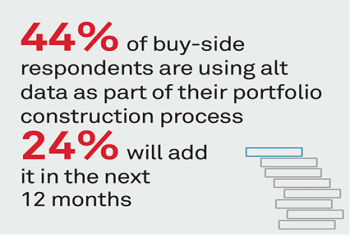

The urgency of managing alternative datasets is forcing asset managers and asset owners to consider a more modernized architecture and approach to systems.

In a year of surging capital market inflows and soaring equity market valuations, the biggest challenge for many asset managers was getting their funds to stand out in a crowded field of products on retail distribution platforms. In both Europe and...

Asset managers are working to create “client-centric” business models that allow them to deliver superior service to all clients and to partner with their best clients as strategic advisors.

Trading in the secondary market carried on with the status quo for much of September.

Trading in the U.S. interest rate markets came back to life in September after what had been a remarkably quiet summer.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder